GPU costs are all the way down to regular ranges, lastly. Exhale, take a step again; the GPU scarcity is over. However don’t get snug for lengthy. I don’t have a crystal ball, nevertheless it’s a good suggestion to begin planning now if you need among the finest graphics playing cards.

Whereas costs are decrease than they’ve been in practically two years and next-gen GPUs are on the horizon, one other potential scarcity might imply months extra of ready. And the final 5 years and two graphics card generations have proven that one other increase in crypto might trigger inflated costs once more.

Isn’t there a greater means?

You’d assume that after 5 years and two catastrophic generations that AMD, Nvidia, and cryptominers would determine a extra elegant answer to mining than shopping for up a bunch of graphics playing cards. They usually have, however one drawback causes one other to spring up, which is an enormous motive why GPU shortages could also be much less of an occasion and extra of a cadence.

On the finish of 2017 into 2018, the speak was all about Bitcoin. As I’ll dig into later, the demand for graphics playing cards went up as the worth of Bitcoin did. The rationale? Effectively, GPUs are a lot better than CPUs for mining, which is why they’re usually focused. However Bitcoin miners have an much more environment friendly device as of late — ASICs, or application-specific built-in circuits. Because the identify implies, they’re computer systems optimized for one functions solely — and on this case, that’s cryptocurrency mining.

Though it’s straightforward to gawk at an aspiring miner shopping for up 5 or 10 graphics playing cards, a lot greater costs and shortages come from industrial mining, the type that occurs at scale. These miners are largely utilizing ASICs to mine Bitcoin now versus gobbling up graphics playing cards that supply a a lot decrease return on funding.

Enter Ethereum, a cryptocurrency that has joined the ranks of Bitcoin in identify recognition. The GPU scarcity of 2020 largely got here from Ethereum, which has the signature trait of being ASIC-resistant. That’s proper, Ethereum is particularly designed to withstand working with ASICs. There are a selection of the reason why for the crypto group — decentralization of computing energy chief amongst them — however the essential level is that Ethereum works greatest with GPUs whereas Bitcoin has largely moved on to ASICs.

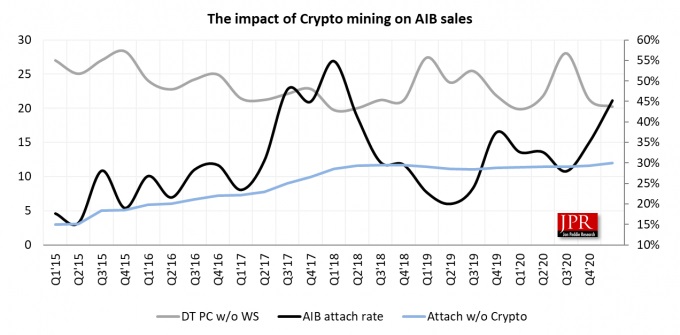

And make no mistake: Ethereum was the driving power behind mining-related gross sales. Ethereum miners spent about $15 billion on GPUs over the previous yr and a half, which is almost 25% of all GPU gross sales. One report recommended {that a} quarter of GPU gross sales within the first half of 2021 went to miners, too.

No matter what new cryptocurrencies develop into fashionable, or if Ethereum ever strikes to proof-of-stake, it’s clear that graphics playing cards play a crucial function in cryptocurrency mining — and so they possible at all times will. The one means for GPU demand from cryptocurrency miners to go away is for cryptocurrency to go away, and that’s not taking place any time quickly.

Provide chain solved?

The pandemic undoubtedly had an impact of costs, however the speedy drop in GPU costs in early 2022 exposes what was supporting such excessive, sustained costs. Simply days earlier than $800 billion in cryptocurrency worth disappeared from the market in Might, GPUs dropped by round 15%. And a month later, as crypto costs continued to drop, GPU costs dropped one other 15%.

It’s true that the provision chain points worsened and extended the GPU scarcity, however we now have historic context to see that it wasn’t the provision chain alone. Bitcoin, when it was nonetheless being mined with GPUs, went from round $7,000 per coin in November 2017 to almost $18,000 originally of 2018. And through that very same interval, the costs of GPUs practically doubled. You don’t even must look that far again to see the correlation. The time period “GPU costs” reached it highest-ever search quantity (together with throughout the newest GPU scarcity) originally of 2018.

And, in fact, there wasn’t a pandemic at the moment. The bettering provide chain has helped GPU costs drop beneath MSRP, however the mass drop-off in worth largely got here when Ethereum dropped. It’s been on a gradual decline because the starting of 2021, nevertheless it noticed its largest dip in Might (round 32%), proper as GPUs turned way more inexpensive.

Some estimates says the chip scarcity gained’t be absolutely over till 2024, and admittedly, provide chain points don’t all of a sudden disappear inside a month. The GPU shortages of 2017 and 2020 are advanced and based mostly a whole lot of various factors, however the constant thread between them is crypto, and that’s essential to remember for next-gen GPUs.

Subsequent-gen on the horizon

If Nvidia and AMD sustain their regular launch cadences, we count on RTX 40-series and RX 7000 GPUs later this yr. Hopefully we gained’t expertise one other GPU scarcity, nevertheless it’s going to return all the way down to the demand from cryptocurrency miners.

Though the scarcity in 2017 got here on as fiercely because the one in 2020, it didn’t final practically as lengthy. GPU costs boomed over the course of about six months, shortly earlier than crypto flatlined. In 2020, the problems with the provision chain simply compounded an identical state of affairs, stretching it out over the course of practically two years.

The final two generations have been marked by distinctly excessive GPU costs as crypto soars, and there’s no motive to assume this technology shall be any completely different. The excellent news is that, though we might even see greater costs as next-gen GPUs begin to roll out, we in all probability gained’t discover ourselves caught in two years of GPU hell.

Editors’ Suggestions