This text first appeared in The State of Vogue: Know-how, an in-depth report co-published by BoF and McKinsey & Firm.

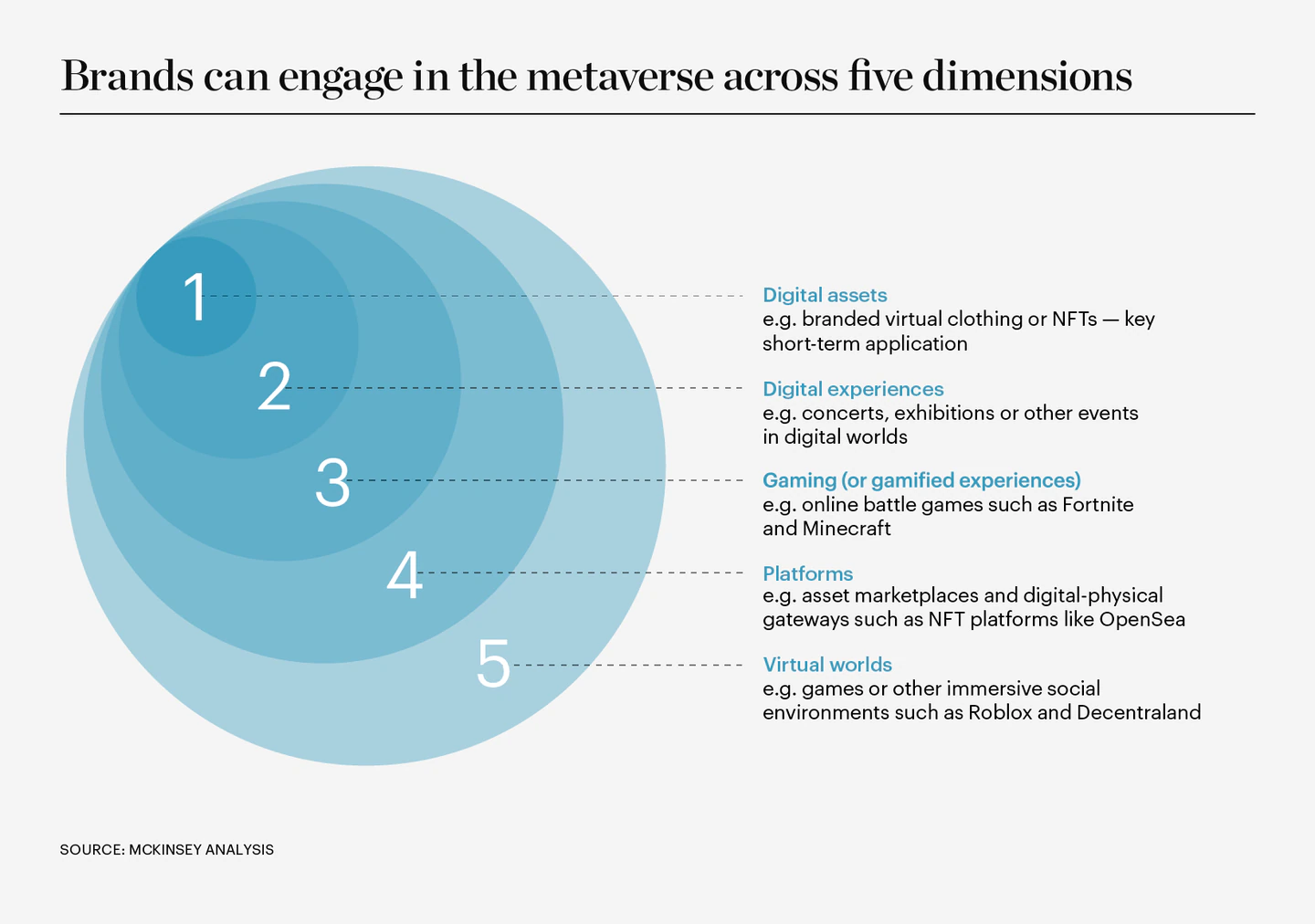

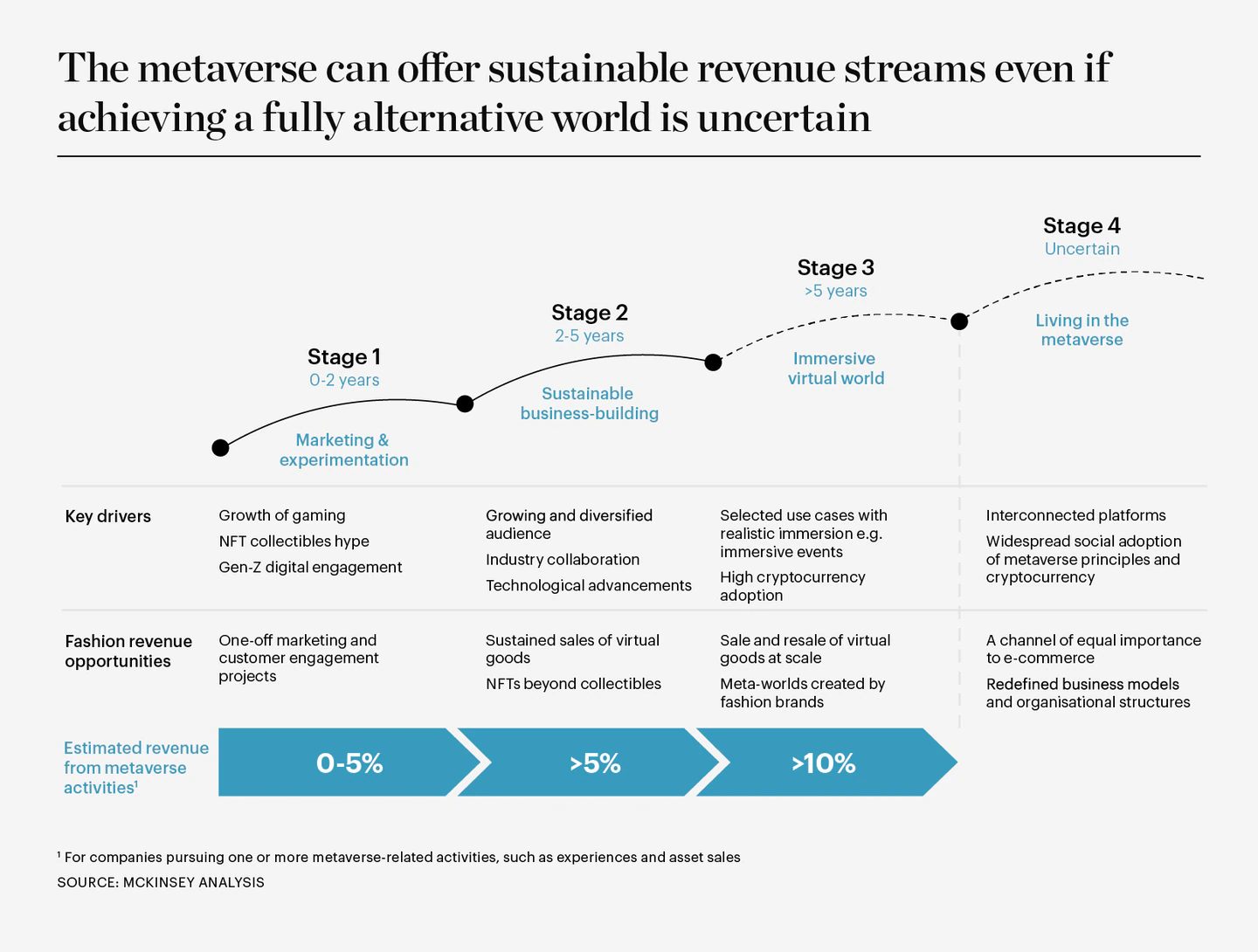

Pioneers within the metaverse have proven there’s a enterprise case for vogue manufacturers to put money into digital worlds. Granted, a completely fashioned metaverse — comprising an interconnected, digital ecosystem that overlaps with or provides a substitute for bodily actuality — just isn’t but attainable given expertise constraints. However manufacturers’ experiments with metaverse rules, comparable to digital vogue, prolonged actuality, gaming and non-fungible tokens (NFTs), exhibit the affect that digital actions can have as advertising and marketing and community-building instruments for vogue. International spending on digital belongings reached round $110 billion in 2021 and is predicted to develop at roughly the identical fee because the gaming market to be price round $135 billion or increased by 2024.

The following frontier for main manufacturers shall be to translate unproven applied sciences into sustainable income streams, successfully separating hype from actuality. Over the subsequent two to 5 years, vogue manufacturers centered on metaverse innovation and commercialisation might generate greater than 5 p.c of revenues by investing in digital actions right now.

Wanting past a five-year horizon, some bullish observers count on mass shopper adoption of digital worlds, creating the largest alternative for the style business since e-commerce. The bears predict that the hype across the metaverse will fade as applied sciences fail to fulfill expectations or customers show reluctant to make use of digital areas as extensively as some enterprise plans are relying on.

Whereas it’s unsure whether or not a significant variety of customers will develop totally fledged digital lives and spend most of their time within the metaverse, vital income alternatives for vogue manufacturers will emerge.

The tempo of adoption shall be pushed by technological development, the interoperability between digital environments and social acceptance. Tech gamers in addition to vogue start-ups and types must develop applied sciences that assist evolve right now’s unrefined digital experiences into mature, immersive realities. Mass shopper adoption may very well be a major hurdle — 78 p.c of people that have already ventured into digital worlds say they miss bodily interplay when doing so.

Because of this, many gamers will possible hold again to see proof of commercialised use circumstances and a tangible ROI earlier than investing. For others that wish to seize the industrial alternative, the largest short-term income potential lies with digital belongings that may be traded, transferred or used for fee. We determine two clear use circumstances for digital belongings which have long-term potential:

AR Vogue and Digital Skins

In digital areas and on social media platforms, the urge for food for creating and adapting on-line identities is excessive: roughly 70 p.c of US customers from Gen-Z to Gen-X fee their digital id as “considerably necessary” or “crucial.” An analogous urge for food for digital items might be present in China, the place 70 p.c of luxurious customers have bought or will contemplate buying digital belongings.

Some corporations are utilizing augmented actuality (AR), to allow customers to change images and movies, and are creating digital skins to vary the looks of a person’s avatar. For instance, digital vogue start-up DressX, which sells digital clothes that may be added to a photograph and posted on social media, has partnered with manufacturers comparable to H&M to launch digital collections. In the meantime, customers on on-line gaming platforms comparable to Roblox replace their avatars with new skins commonly, even each day in some circumstances. The potential income era of in-game outfits and equipment might be vital. Gucci offered a digital model of its Dionysus bag for the equal of $6 on Roblox, which later led to bids of greater than $4,000 per bag when resold on the secondhand market.

The multi-billion-dollar gaming market will proceed to supply alternatives for vogue — the marketplace for gaming skins might attain $70 billion by 2024, up from $40 billion in 2020. Manufacturers might want to flip to established gaming and platform companions to seek out inroads.

Over the subsequent two to 5 years, vogue manufacturers centered on metaverse innovation and commercialisation might generate greater than 5 p.c of revenues by investing in digital actions right now.

Nonetheless, as with every nascent expertise, there are dangers. For one, manufacturers — significantly these in luxurious — ought to concentrate on promoting “low-cost” digital objects that might weaken the exclusivity of their model picture. AR expertise is at a comparatively early part of growth, the place glitchy or unwieldy purposes can undermine the person expertise.

Moreover, if manufacturers select to associate with digital platforms, in gaming or in any other case, the top-line alternative could also be dampened by excessive take charges, which might attain as excessive as 50 p.c fee on revenues.

NFTs as Digital Twins and Loyalty Tokens

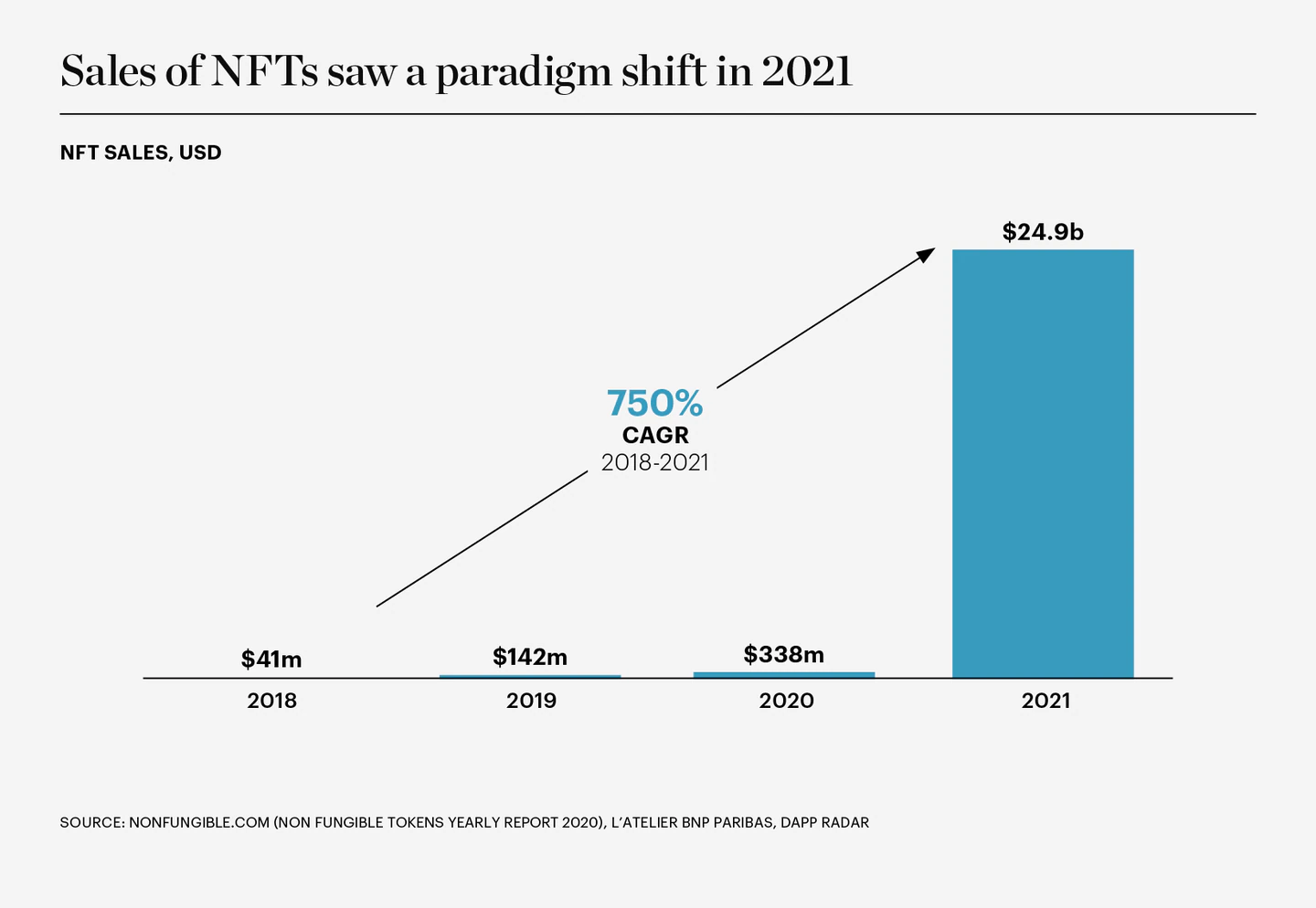

A lot of the frenzy about blockchain-based NFTs has been centred round digital artwork collectibles, that are in some circumstances purchased and traded for inordinate sums, driving information headlines as some observers scratch their heads. The compound annual progress fee of the worth of the NFT market skyrocketed 750 p.c between 2018 and 2021, from $41 million to $24.9 billion.

However the fast fee of progress in NFT gross sales is already beginning to average. Certainly, the each day buying and selling quantity on NFT market OpenSea fell by 80 p.c between February and March 2022. NFT sceptics counsel that this might point out the bursting of a bubble in an unsustainable market with a restricted variety of energetic prospects and rampant hoaxes and scams.

Nonetheless, even because the hype subsides, use circumstances will emerge that handle business ache factors and shopper needs with purposes that assist neighborhood constructing, product traceability and authenticity.

The long-term enterprise alternative for vogue manufacturers to have interaction with NFTs will possible serve extra pragmatic functions through the use of NFTs as “loyalty tokens.” Gucci, Adidas and The A whole bunch, amongst others, have used NFTs to supply advantages like early entry to new NFT drops and bodily merchandise, primarily serving as a membership programme. In a way, these NFTs are digital collectibles, since customers can’t but put on them in digital worlds, although they may use them for social media profiles. Manufacturers are beginning to add extra “utility” to collectible NFTs, which might make shopping for yet another worthwhile to customers and translate right into a long-term alternative for manufacturers.

We see probably the most compelling use case for NFTs as digital twins that host details about a bodily or digital product’s historical past, authenticity and possession — one thing that’s particularly helpful to the luxurious section in its battle in opposition to counterfeiting. Twins allow merchandise to be paired with a theoretically tamper-proof document and unlock the flexibility for manufacturers to gather royalties from resale. A bunch of start-ups and business initiatives comparable to Aura Blockchain Consortium, Lablaco and Arianee are aiming to make blockchain-based digital twins commonplace. Lablaco is working to hyperlink its digital IDs to digital variations of clothes, in order that prospects can have interaction in augmented actuality experiences comparable to try-ons.

Accomplice, Construct, Purchase

Whereas a number of disruptors, comparable to marketplaces for digital vogue, will solely give attention to digital items, most tech-savvy, progressive manufacturers will faucet the chance to diversify income streams and goal Gen-Z and Millennial customers. Gamers that wish to experiment within the metaverse however lack the requisite in-house capabilities can:

- Accomplice with gaming or tech corporations, as Gucci did in its tie-up with Zepeto, a social community and avatar simulation app, to provide paid-for digital skins, or as Burberry did when it partnered with Tencent to launch a limited-edition scarf with the Chinese language digital influencer Ayayi.

- Construct their very own capabilities by recruiting expertise with tech-related expertise alongside a deep-rooted understanding of the metaverse and its communities, as Balenciaga is doing by making a “metaverse enterprise unit” devoted to metaverse advertising and marketing and commerce.

- Make acquisitions, alongside the strains of Nike’s deal to purchase digital vogue studio RTFKT in 2021.

Just like the early days of e-commerce, some metaverse-related ventures are prone to fail outright or want fast iteration. Nonetheless, vogue is properly positioned to capitalise on the engagement with digital worlds and the metaverse, owing to its connection to self-expression, standing and creativity. Executives ought to contemplate metaverse methods based mostly on their corporations’ digital ambitions and buyer targets.