- When you possibly can’t pay lease, speak together with your landlord, handle your bills, and discover assist via group packages.

- Emergency rental help packages are government-funded sources that present cost to landlords on behalf of tenants.

- Support is usually processed via the state or county, so examine your native jurisdiction to see should you qualify.

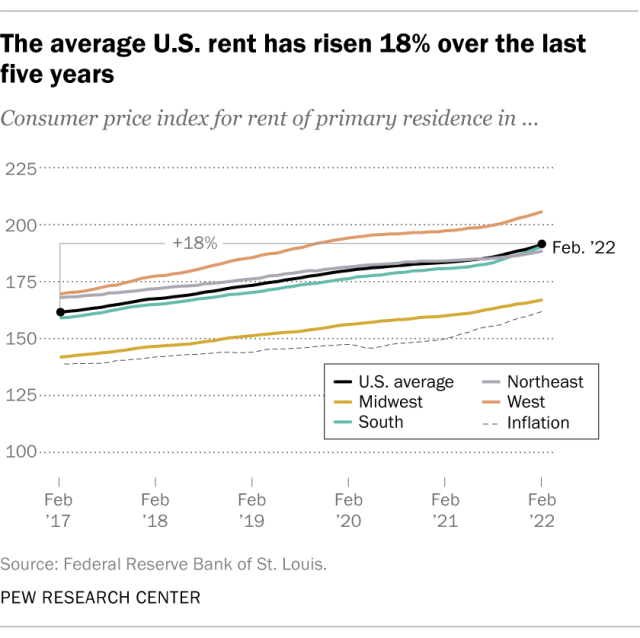

US rents have elevated 18% on common up to now 5 years, outpacing each inflation and wage development. Whereas wages within the US are rising, they’re doing so at a significantly slower tempo in comparison with the price of lease. Previously 12 months alone, wages rose about 5% whereas lease costs rose by 15%.

These numbers should not simply statistics, however a scary actuality for renters, who make up a couple of third of the US inhabitants. If there comes a second when you possibly can’t pay lease, there are alternatives designed to assist.

Steps you possibly can take if you cannot afford lease

Although each scenario could also be barely completely different, there are expert-recommended finest practices anybody can take. “You do not need to fake it may go away,” says Regina Carmine, NACCC Licensed Monetary Counselor and HUD Licensed Housing Counselor on the Pittsburg Monetary Empowerment Heart. “You really want to take care of it immediately or forward of time if in any respect doable.”

1. Speak to your landlord

As quickly as you understand you will not be capable to make a full rental cost, you must communicate together with your landlord or property supervisor as rapidly as doable. “It is the very first thing you must do, and doubtless essentially the most troublesome factor you will need to do,” Carmine says. Whereas it may be uncomfortable, it is vital to ascertain an open line of communication, and on this approach, your landlord could also be extra keen to come back to an settlement that advantages each events.

It’s best to collect any documentation you have got that reveals a lack of earnings or the explanation you are unable to make a lease cost. “It is higher to be ready with extra info than obligatory,” Carmine says. “Inform the story so they do not need to ask.”

Once you provoke that dialog, it may possibly assist to come back ready with a proposed resolution or compromise. “There are undoubtedly plenty of agreements,” says Dana Amundson, MSW, LGSW, and the housing program coordinator at Mediation and Restorative Companies, a 501(c)(3) nonprofit group. Amundson helps landlords and tenants come to agreements in conditions just like these. Mostly, she sees cost plan resolutions, which frequently span a month or an extended interval relying on how a lot is owed.

“It is actually vital to be practical about what you possibly can conform to,” she provides, because it would not serve anybody if one get together cannot comply with via with their facet of the settlement. She’s additionally mediated move-out plans, the place the owner and tenant come to an settlement to assist the renter break a lease early with out repercussions. As soon as you’ve got come to a decision, get every little thing in writing.

2. Discover a checklist of organizations that may show you how to

After talking together with your landlord, you possibly can discover organizations that might be able to supply emergency support for housing or lease bills should you qualify. Modest Wants affords grants for emergency bills, together with lease and utility payments. The Multifamily Housing Rental Help program affords rental assist to homeowners of USDA-financed Rural Rental Housing or Farm Labor Housing tasks on behalf of tenants. The Salvation Military additionally affords one-time rental help to folks struggling to pay lease, (to see should you qualify, contact your native Salvation Military, as funds and packages range from metropolis to metropolis). “If you happen to dial 2-1-1 and say you need assistance with lease, they will put you in contact with a dozen organizations in your space,” Carmine provides.

Moreover, some nonprofits supply rental and emergency help to folks in particular skilled industries, significantly the humanities, who’ve misplaced their earnings supply or skilled monetary hardship.

3. Handle your bills

As you’re employed together with your landlord and any packages that may supply help, managing your money outflow shall be one other vital step. “When taking a look at tips on how to handle debt and ensuring our money move is constructive or a minimum of impartial, the magic phrase is budgeting,” says Michael Cocco a CFP® skilled with Equitable Advisors. He suggests writing down each expense and categorizing it as a need or a necessity. “There are basic items — like meals and shelter — that every one of us want, however there are different issues that go a bit of too far that we’ve to replicate on and look inward.”

Carmine suggests making a “precedence price range.” For any such system, you prioritize sure bills and decrease others that are not of prime significance. “It begins with the issues which are immovable, primarily your lease and your mortgage,” she says. From there, you think about different bills like utilities, payments, meals, and leisure. Ideally, you reduce on or decrease issues towards the underside of the checklist to make sure every little thing on the prime is paid for. ” it on paper is what’s actually eye-opening for many,” Carmine provides.

Each monetary professionals additionally suggest calling utility corporations and different service suppliers to barter charges. “Generally solely a 15-minute name might decrease your invoice by $25 to $30 a month,” Cocco says.

Nevertheless, reducing again could solely go up to now, so it is also vital to contemplate any methods you possibly can earn extra earnings, whether or not that is exploring additional compensation with a boss or making use of to different positions. “Some folks could not have a job,” Cocco provides. “In that case, I might encourage folks to look into authorities packages that might be able to assist.”

4. Take into account rental help

If you happen to’re struggling to afford lease, then rental help packages might be able to show you how to. These packages are sometimes administered on the state or county degree and supply emergency rental help to qualifying candidates normally within the type of grants that do not should be paid again. “I’ve by no means identified any of those packages to demand reimbursement,” Carmine says.

Usually, these are financial aid packages funded by the federal government to assist folks in numerous communities in instances of hardship. “We at all times suggest folks attain out to their native county sources, and people county staff may help direct you thru the applying in your jurisdiction,” Amundson says.

The way to qualify for rental help

Qualifying for rental help can range from state to state and even by county. Many states have COVID-related help that requires you to show monetary want based mostly on the pandemic. “They alter {qualifications} very incessantly,” Carmine says, noting it is best to examine together with your native program to find out should you meet the eligibility necessities. If you happen to do not, she recommends monitoring this system incessantly for any updates.

In some cases, renters apply themselves, though, in different communities, the owner has to submit an utility first. Because of this, it is extraordinarily vital that the upfront dialog with the property proprietor happens. Amundson typically sees these conversations occurring in mediation. “It helps to work collectively to determine who’s going to do what, who’s going to offer what paperwork, that form of factor,” she says.

The way to discover rental help packages in your state

Carmine suggests working from a top-down method on the subject of discovering rental help packages in your space. “I might begin large,” she says, recommending folks take a look at the Division of Housing and City Improvement and Shopper Monetary Safety Bureau. From there, people can search their state or county plus “emergency rental help” or name 2-1-1.

*Program is closed; Data on this desk is up to date as of June 27, 2022.