Hewlett Packard Enterprise has been an early and enthusiastic supporter of alternate processor architectures exterior of the usual Xeon X86 CPUs that comprise the overwhelming majority of its revenues and shipments, notably with Arm server chips beginning in 2011. Possibly now, the fourth time would be the appeal because it provides Ampere Computing’s “Mystique” Altra Max Arm server chip as a motor in a normal ProLiant rack-mounted server.

The CPU provider settlement with Ampere Computing is certainly a water-shed occasion for that specific Arm server chip maker, touchdown its first massive OEM server maker after having some success getting Baidu, Tencent, Alibaba, Oracle, and now Microsoft to undertake its 80-core Altra and 128-core Altra Arm CPUs of their customized server infrastructure – largely for inward going through workloads, however more and more for outward going through ones bought as uncooked infrastructure for shoppers of their clouds who wish to know extra about Arm servers.

The announcement, made at HPE’s Uncover 2022 buyer and companion occasion, is pretty modest as this stuff go, with just one machine – the one socket, 1U rack server referred to as the ProLiant RL300 – within the lineup. And given HPE’s historical past with Arm servers, you possibly can in all probability perceive why the corporate is enjoying it a bit extra cautiously.

Again in November 2011, the corporate was identified simply as Hewlett-Packard and it had adopted the four-core EnergyCore ECX-1000 Arm server chip from Calxeda, which was actually a system-on-chip with a single DDR3 reminiscence controller, an built-in administration controller, 4 PCI-Specific 2.0 controllers, a SATA 2.0 controller for flash and disk storage, and a material change with eight 10 GB/sec Ethernet channels (three for interconnecting with three different ECX-100 chips on a board, and 5 to speak to the surface world, together with different boards interlinked in a mesh). The “Redstone” server playing cards utilizing the Calxeda processor had been a part of the “Moonshot” hyperscale server design effort launched with a lot fanfare by Hewlett-Packard on the similar time Calxeda uncloaked. However the Calxeda chips solely had 32-bit processing and reminiscence addressing, and whereas 48-bit chips had been on the roadmap, it was going to take years so as to add 64-bit chips and that was simply too lengthy for both Calxeda or Moonshot to get off the bottom.

Again in 2017, Hewlett Packard Enterprise, as the corporate was known as after the spinout of its PC and printer enterprise, anointed Cavium’s ThunderX2 server chip as the following nice Arm hope. (Properly, it was actually Broadcom’s recycled “Vulcan” Arm server chip.) The ThunderX2 was put into HPE’s “Comanche” Apollo 70 dense, barebone servers. A bunch of those programs had been bought, however nothing near volumes, and some time after Marvell purchased Cavium for $6 billion and some HPC programs had been up and working testing out the ThunderX2, Marvell was getting set to launch the “Triton” ThunderX3 follow-on after which, as 2020 got here to a detailed, Marvell spiked ThunderX3 like Broadcom spiked ThunderX2, and this time, nobody picked up the items. Though there have been some rumors that Microsoft would possibly do it at across the similar time.

After which, a bit greater than two years later, Microsoft tapped Ampere Computing as its Arm server chip provider. We did an intensive evaluation of the Altra situations working on the Azure cloud, and calculated they’re delivering someplace between 1 / 4 to a 3rd higher value/efficiency than situations based mostly on the AMD “Milan” Epyc 7003 processors on Azure. And for the entire causes that we now have mentioned prior to now concerning the Altra line of chips, and primarily as a result of it’s a chip geared toward hyperscalers and clouds and cloud native workloads that carry out extra constantly on a core with a set clock velocity and no simultaneous multithreading, HPE is including the Altra chips to its mainstream ProLiant machines.

(An apart: As we now have mentioned right here prior to now, HPE can also be an enthusiastic supporter of Fujitsu’s A64FX Arm processor, designed with massive fats vector math items and used within the “Fugaku” supercomputer at RIKEN Lab in Japan, which is has added to its Apollo 80 programs.)

It’s that deterministic efficiency and that value/efficiency that has attracted HPE to the Altra CPUs, and the truth that HPE shouldn’t be promoting this as a particular Moonshot kind of server, or considered one of its Cloudline el cheapo hyperscaler bins, however in a normal ProLiant machine that comes with an iLO or OpenBMC baseboard administration controller generally utilized in enterprises, exhibits that HPE is severe.

“HPE and ProLiant have introduced 30 years of management and innovation in compute in a sea of followers,” explains Neil MacDonald, govt vp and basic supervisor of the Compute group at HPE. “We’ve been dedicated deeply to innovation in compute, whether or not that’s automation administration, efficiency, safety, or energy effectivity. And it is a very, very pure subsequent step in our journey to carry compute options with cloud native silicon to help these rising markets and out altering buyer wants. We’re thrilled to be working with Ampere, who’re delivering that subsequent era compute pushed by the cloud for the datacenter, and Ampere is modernizing that core compute for cloud software program and cloud workloads.”

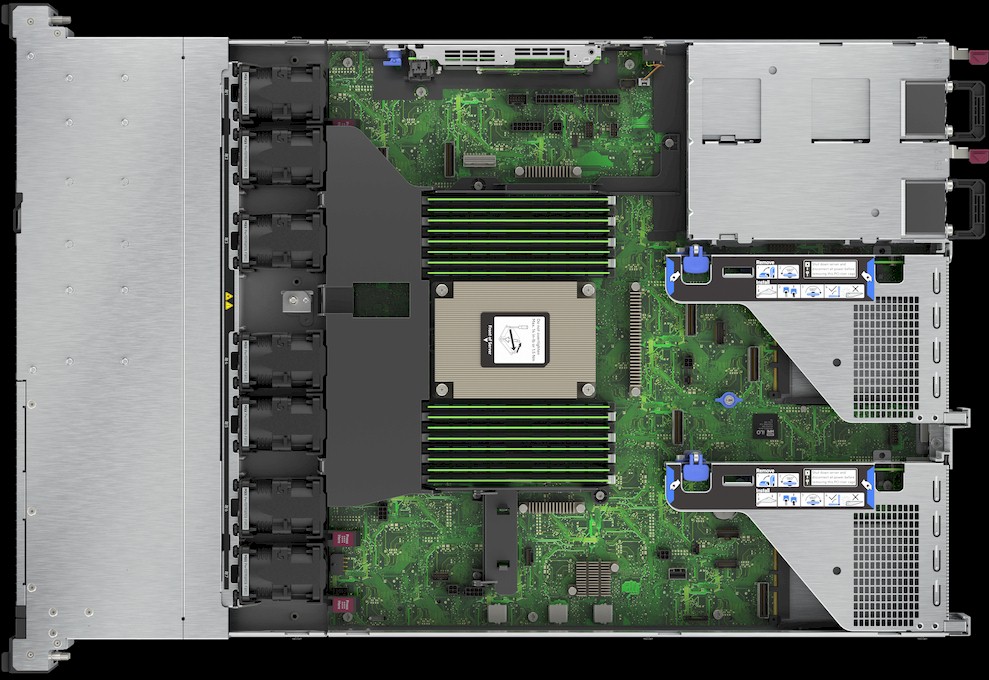

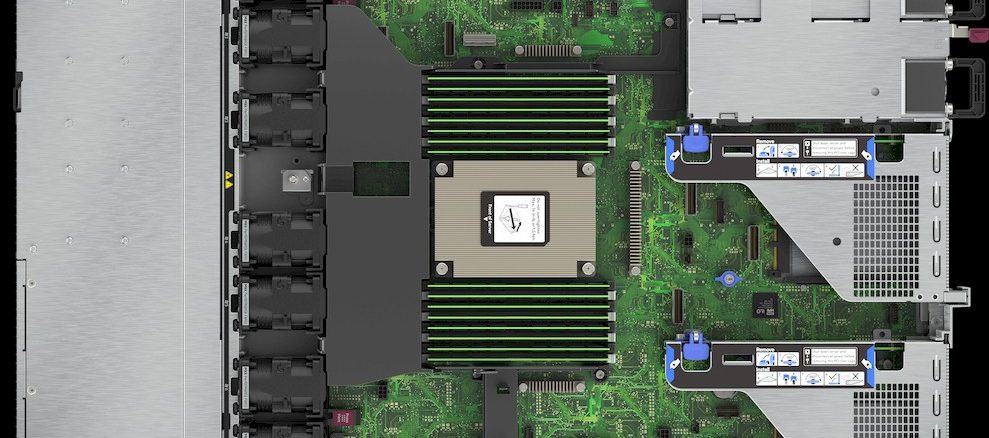

There aren’t plenty of feeds and speeds out there for the ProLiant RL300 server, however it’s a single socket server in a 1U chassis that has 16 DDR4 reminiscence slots with as much as 4 TB of predominant reminiscence, which is lots for a single-socket machine. Each the 80-core Altra and 128-core Altra Max chips will plug into the socket of the field, which has three PCI-Specific 4.0 slots and two OCP 3.0 slots. The machine has as much as two M.2 NVM-Specific flash reminiscence sticks and ten small kind issue NVM-Specific SSDs.

The ProLiant RL300 will likely be out there within the third quarter. Pricing was not divulged, however we presume it will likely be aggressively priced towards ProLiant machines utilizing Intel Xeon SP and AMD Epyc processors – and that on this case, extra of the margin will hit HPE’s backside line than has occurred prior to now with Xeon SPs.

We additionally presume that HPE will do a broader product portfolio, together with a two-socket workhorse machine that competes towards the flagship ProLiant DL380 utilizing Xeon SPs and its rival, the ProLiant DL385 utilizing Epycs. We additionally anticipate extra compact sled servers for the Apollo line for many who need extra density than these ProLiants provide. A 1U field at full width with just one server socket in it isn’t all that dense, and it’s affordable to anticipate a 2U chassis with 4 sleds in it sooner or later. If HPE is as severe concerning the Ampere Arm server chips as MacDonald positively needs us to imagine. When requested concerning the supply of such a full line, MacDonald smiled and stated this:

“After we make selections on expertise, we’re making them very thoughtfully with a lens to the longer term. And there are different actions already within the works, that I’m not going to be speaking about as we speak by way of issues that we will do sooner or later. However we’re very excited concerning the alternative and the ecosystem that’s in place round this platform.”

Like we stated: After we see a ProLiant RL380 and an Apollo 2000 utilizing Ampere Computing’s Altra CPUs, we are going to know that HPE is basically severe.