Augmented actuality (AR) and digital actuality (VR) are two of the most important tendencies within the expertise trade proper now. Thus far, lots of the makes use of of those rising applied sciences have been within the gaming trade, with VR headsets changing into more and more fashionable in recent times.

However AR and VR expertise isn’t just restricted to gaming, and as work-from-home turns into a everlasting actuality for extra firms, these applied sciences will doubtless develop from client to enterprise markets. Right here’s what else you need to find out about digital and augmented actuality.

Key AR/VR statistics:

- The worldwide VR market is anticipated to develop from $4.5 billion in 2020 to $22.4 billion in 2025, in accordance with AR analysis agency ARtillery Intelligence.

- Client spending is anticipated to account for about 60 % of the market in 2025, whereas enterprise spending is anticipated to make up 40 %, in accordance with ARtillery.

- The worldwide head-worn AR market is anticipated to succeed in $17.7 billion in 2025, up from $1.6 billion in 2020, in accordance with ARtillery.

- Meta Platform’s Quest 2 VR headset offered 8.7 million models in 2021, in accordance with a report from Worldwide Knowledge Company, commanding about 78 % of all headset gross sales.

- The cell AR market is anticipated to succeed in $36.3 billion globally in 2026, up from $12.5 billion in 2021, in accordance with ARtillery.

AR/VR: A quickly increasing market

AR and VR are two of the quickest rising areas of expertise. World giants resembling Fb mother or father firm Meta Platforms, Microsoft and Sony are closely investing in these applied sciences to gasoline their progress for years to come back. The worldwide VR market is anticipated to develop at an annual fee of just about 38 % from 2020 by way of 2025, in accordance with ARtillery Intelligence, whereas the worldwide head-worn AR market is anticipated to develop by 11 occasions over the identical interval.

The expansion is anticipated to be pushed by new makes use of of the expertise past gaming, resembling healthcare, engineering, protection and leisure. Meta plans to spend billions to construct the metaverse, which can depend on VR and AR expertise.

Advances in AR/VR expertise

- Meta Quest 2: The Meta Quest 2 headset has been fashionable with the gaming group, promoting 8.7 million models in 2021. The product comes with a VR headset and two contact controllers that assist to simulate actuality.

- PlayStation VR2: The PlayStation VR2 is a competitor to the Quest 2 headset and pairs with the PS5 gaming system. The headset tracks your eyes, making for a life-like gaming expertise.

- Sensible glasses: A number of firms have entered or re-entered the sensible glasses market, together with Alphabet and Meta. The glasses differ from mannequin to mannequin, however they’ll assist you to take photos and video, in addition to reply telephone calls. Meta even partnered with Ray-Ban to attraction to extra style-conscious shoppers.

- Apple: Apple has lengthy been rumored to be popping out with an AR/VR headset, however till that comes, the tech big’s many followers can use their iPhones and iPads to entry one of many hundreds of AR apps on the app retailer. You may see how furnishings appears in your precise lounge earlier than shopping for it or mess around with totally different filters on Snapchat.

(Try Bankrate’s record of one of the best funding apps.)

The right way to spend money on AR/VR firms

For those who’re serious about investing on this rising expertise, you’ve a few totally different choices to think about. You may establish particular person firms that you just assume will profit from the expansion in AR/VR expertise and buy their shares, or you’ll find a mutual fund or ETF that invests in a basket of firms alongside this theme. Listed here are some choices:

Standard shares to think about:

- Meta Platforms (META): The corporate previously generally known as Fb is without doubt one of the leaders in AR and VR expertise. It’s investing billions of {dollars} within the metaverse and is the maker of the favored Quest 2 headset. Remember that the overwhelming majority of Meta’s income and income come from digital promoting by way of its household of apps resembling Fb, Instagram and WhatsApp.

- Alphabet (GOOG): Equally to Meta, most of Alphabet’s gross sales and income come from internet advertising, however the firm has invested in AR/VR tasks that might repay. It was among the many first to introduce a wise glasses product and has practically unmatched assets to pursue new alternatives.

- Microsoft (MSFT): Chances are you’ll consider comparatively boring merchandise like Phrase, Excel and Powerpoint whenever you consider Microsoft, however the firm can also be deeply concerned in gaming because the maker of the Xbox. Microsoft additionally introduced plans to amass Activision Blizzard in 2022, doubtlessly pushing deeper into the gaming world.

- Apple (AAPL): As one of many largest firms on the earth, Apple has the power to rapidly thrust itself into practically any market by way of an acquisition or funding in new merchandise. It has been rumored to be engaged on a VR headset and presents iPhone and iPad customers entry to hundreds of AR-enabled apps by way of its app retailer.

- Nvidia (NVDA): Nvidia makes the expertise that powers the units and applied sciences that use AR and VR. Its graphic-processing models are utilized in pictures and animation in addition to different areas that require high-performing chips, resembling gaming.

Prime AR/VR funds to think about:

*Be aware: Knowledge as of June 15, 2022.

- Communication Companies Choose Sector SPDR Fund (XLC): This fund holds shares in firms within the telecommunication providers, media and leisure industries and consists of many firms that ought to profit from progress in AR and VR applied sciences. About 40 % of the fund’s property are invested in Alphabet and Meta.

3-year annualized return: 5.5 %

Expense ratio: 0.10 %

Whole property: $9.3 billion

- VanEck Semiconductor ETF (SMH): This ETF seeks to trace the general efficiency of firms concerned in semiconductor manufacturing and tools. Prime holdings embody Nvidia, Taiwan Semiconductor (TSM) and Broadcom (AVGO).

5-year annualized return: 22.3 %

Expense ratio: 0.35 %

Whole property: $6.9 billion

- Invesco QQQ Belief (QQQ): This ETF relies on the Nasdaq-100 Index and consists of about 100 of the most important non-financial firms listed on the Nasdaq Inventory Market primarily based on market capitalization. Prime holdings embody many AR/VR leaders resembling Apple, Microsoft, Nvidia, Alphabet and Meta.

5-year annualized return: 16.1 %

Expense ratio: 0.20 %

Whole property: $154.8 billion

Actual-world functions of AR/VR

Whereas VR and AR applied sciences sound thrilling, generally the ideas can appear obscure and complicated. Listed here are some real-world examples of how the expertise may be put to make use of.

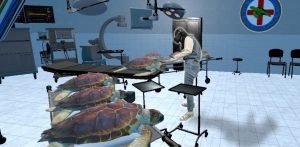

- Schooling/coaching: Think about medical college students having the ability to use a VR headset to learn to carry out surgical procedure or take a look at totally different areas of the physique. Faculties can deliver complicated topics to life utilizing AR expertise to assist college students perceive the ideas.

- Buying: Many shops now assist you to use their app to attempt on glasses to see how they give the impression of being in your face earlier than shopping for or see how furnishings appears in your home earlier than ordering. You would possibly even choose a pair of footwear to customise by way of the app earlier than putting an order.

- Journey/leisure: Chances are you’ll quickly be capable to immerse your self in fictional worlds utilizing VR headsets. Simply assume, Harry Potter followers may really feel like they’re college students at Hogwarts, whereas others may struggle the darkish aspect within the Star Wars universe.

- Restore/upkeep: Mechanics who arrive to repair an equipment or piece of complicated tools might be able to use AR/VR glasses or headsets to rapidly diagnose issues and see potential options with out studying bodily manuals or calling headquarters for assist.

Editorial Disclaimer: All traders are suggested to conduct their very own impartial analysis into funding methods earlier than investing choice. As well as, traders are suggested that previous funding product efficiency isn’t any assure of future value appreciation.