CIBIL rating is a time period thrown by each monetary establishment when extending credit score strains to people. The rating defines your credit score historical past and whether or not you’re worthy sufficient for a mortgage or bank card. The upper the rating, the higher it’s for you. However, what precisely is a CIBIL rating, how is it calculated, what are you able to do to keep up a wholesome rating, how a lot rating do you must safe a mortgage, and tips on how to examine your CIBIL rating. In case you are searching for solutions to those questions, then you’re on the proper place. Learn alongside to search out solutions to your fundamental questions concerning your CIBIL rating and the place to examine your CIBIL rating.

What’s a CIBIL rating?

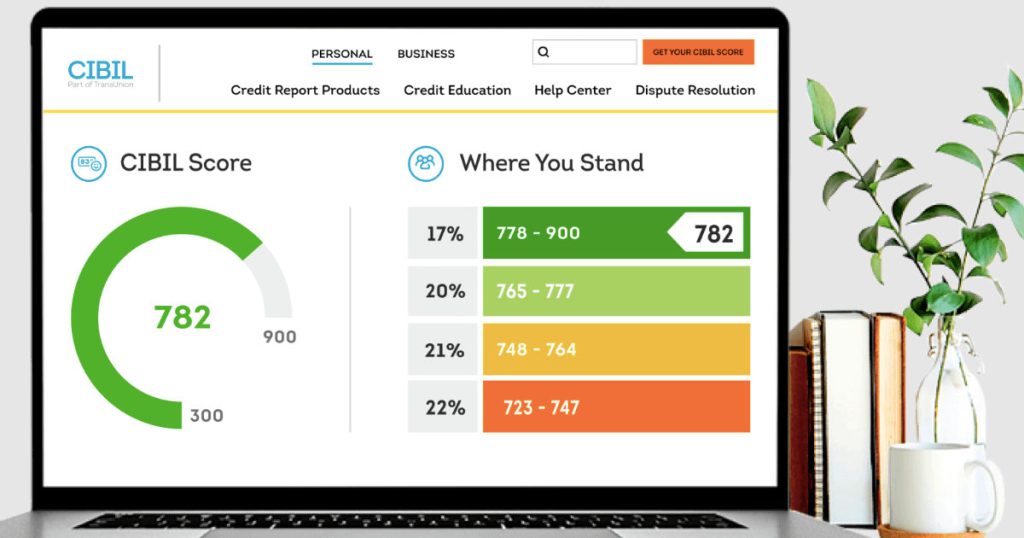

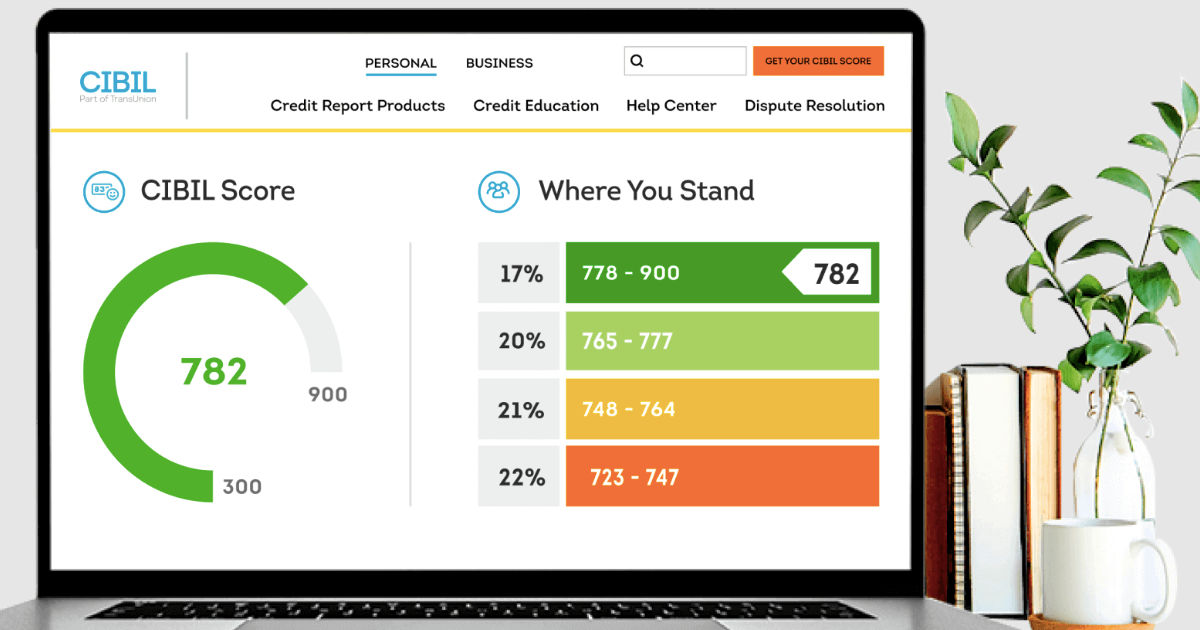

The Reserve Financial institution of India (RBI) has authorised CIBIL, which is an acronym for Credit score Info Bureau (India) Restricted, as a credit score company. The company is answerable for producing CIBIL scores and experiences for people primarily based on their credit score info. Particular person CIBIL scores have in mind 6 months of monetary information of a person earlier than scoring them. The rating is in three digits and often lies between 300-900. The nearer the rating to 900, the higher it’s. 300 is the minimal rating, and you must attempt sustaining your CIBIL rating to a minimum of 750 factors, which can profit you when taking loans as corporations present decrease rates of interest to such people. Paying your Credit score Card payments on time and optimizing the credit score utilisation ratio are some factors you must think about to keep up a excessive CIBIL rating.

Learn how to examine CIBIL rating on-line at no cost

Now that you’ve some fundamental understanding of what CIBIL is and the way it works let’s get into how one can examine your CIBIL rating on-line fully at no cost.

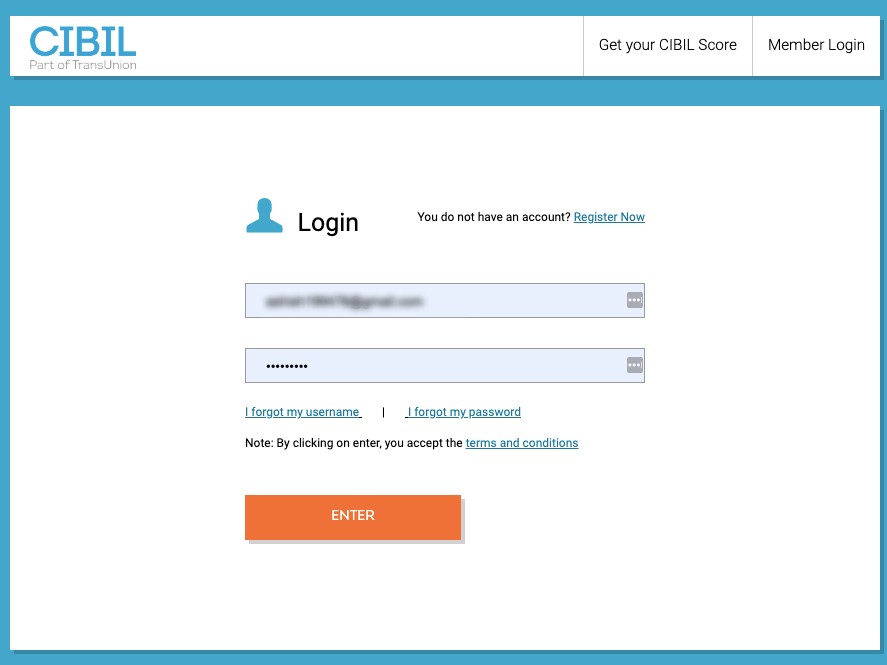

- Open a brand new tab within the net browser of your alternative.

- Head to https://www.cibil.com/freecibilscore.

- Navigate to the Get Your Free CIBIL Rating button and click on it.

- On the following display screen, enter your e-mail handle, identify, cellular quantity, password, and so forth. Guarantee to make use of the fitting cellular quantity as you’ll obtain an OTP, which shall be required within the subsequent step. As an Identification Proof, you’ll have to connect both of these: PAN card quantity, Passport quantity, Voter ID, Drivers license quantity, or Ration card quantity.

- When you’ve stuffed in all the main points, click on the Settle for & Proceed button.

- Enter the OTP you obtain within the textual content field and click on Proceed.

- Click on Go to Dashboard.

Another apps/ web sites to examine CIBIL Rating at no cost

- PayTM

- CRED

- INDmoney

- Credit score Karma

- CreditWise

What is an effective CIBIL rating?

CIBIL rating ranges from 300 to 900. CIBIL rating ranges from 650 to 900. The upper the rating, the higher it’s for a person. It could be finest when you tried sustaining your CIBIL rating above the 750 mark to reap probably the most advantages as a credit score consumer. That stated, the rating is split into 4 ranges and is categorised as,

- 300-549: Poor

- 550-649: Common

- 650-749: Good

- 750-900: Glorious

1. 350-549

In case your CIBIL rating lies between 300-549, it’s thought-about a nasty rating. In case you are on this vary, it could be since you’ve been defaulting in your Credit score Card payments or mortgage instalments. People on this vary are thought-about high-risk and don’t typically get authorized for loans, not to mention the next rate of interest.

2. 550-649

The 550-649 CIBIL rating vary is neither good nor unhealthy; it’s simply mediocre. In case your CIBIL rating lies on this vary, it’s since you’ve defaulted in your funds a few instances right here and there. When you would possibly get authorized for loans on this vary, the rate of interest will certainly be greater.

3. 650- 749

A CIBIL rating between 650-749 is just like the stepping stone to success. In case your CIBIL rating lies on this vary, you will have been paying your dues on time. Banks and different corporations will most actually give you loans at rate of interest. Nonetheless, to get the perfect deal, you will need to cross the brink of 750 factors.

4. 750-900

In case your CIBIL rating lies between 750-900 factors, you’ve reached a wonderful CIBIL rating. You’ll now be capable to get the perfect rate of interest as you’ve been paying your dues on time persistently. Banks may even give you a mortgage with out hesitation, as people on this vary are thought-about low-risk when it comes to paying their Credit score Card payments and mortgage instalments.

Why is an effective CIBIL rating required?

The CIBIL rating is an important determinant of mortgage approval. There are a number of the explanation why people from all walks of life borrow cash from the financial institution. You would possibly come throughout the necessity for an training mortgage when you’re a pupil, a housing mortgage when you intend on shopping for a home, and so forth and so forth. Sustaining a excessive CIBIL rating can be sure that your mortgage is rapidly APPROVED and show you how to get the LOWEST INTEREST RATE potential.

Another excuse to keep up or improve your CIBIL rating is to achieve a HIGH CREDIT LIMIT. In the event you’ve been persistently paying your dues on time, banks will provide to extend your credit score restrict as you’re a low-risk particular person. Banks may even approve greater mortgage quantities from people with a excessive CIBIL rating.

Suggestions to enhance CIBIL rating

There are possibilities that it doesn’t matter what you do, your CIBIL rating doesn’t improve in any respect. In the event you’re in such a state of affairs the place you’re struggling to enhance your CIBIL rating, listed below are some pointers that may show you how to enhance your CIBIL rating from one tier to a different.

1. Punctual invoice funds

Paying your credit score calls payments or mortgage EMI’s on time is step one in the direction of growing your CIBIL rating. In the event you comply with all different steps however are inconsistent with the fee of dues, your CIBIL rating would lower slightly than improve. Because the CIBIL rating takes a sure interval to alter (often 6 months), guarantee that you’re punctual persistently with the fee of dues.

2. Steadiness Secured and Unsecured debt

Secured debt has collateral backing. For instance., Housing mortgage, Automobile mortgage. And so on., have the commodities as collateral. Unsecured debt, nevertheless, has no collateral backing. It’s given to a person primarily based on their creditworthiness, decided by their CIBIL/Credit score rating and their capability to repay. A mixture of Secured debt and Unsecured debt is an effective technique to improve your CIBIL rating.

3. Decrease your Credit score Utilisation Price

Maintaining your Credit score Utilisation Price, often known as the Credit score Utilisation Ratio, under 30% will show you how to attain the next CIBIL rating. Now, what’s Credit score Utilisation Price? In easy phrases, Credit score Utilisation Price is the entire credit score a person is utilising divided by the complete revolving credit score they’ve been authorized for.

For instance, if in case you have 2 bank cards with a restrict of Rs. 50,000, which equals a complete restrict of Rs 1,00,000. Now, if the month-to-month invoice of Credit score Card “A” is Rs 9,500 and the month-to-month invoice of Credit score Card “B” is Rs 10,500, the entire quantities to Rs 20,000. Now, dividing Rs 20,000 by Rs 1,00,000 and multiplying that by 100 offers you a Credit score Utilisation Price of 20%. I hope this instance helped you higher perceive the Credit score Utilisation Price idea.

4. Improve your Credit score Restrict

To decrease your Credit score Utilisation Price, you will have to personal a number of bank cards (which isn’t very advisable), or you will have to get your credit score restrict elevated. The latter is a greater choice as you received’t need to handle too many bank cards and may decrease your Credit score Utilisation Ratio. Furthermore, in case your bills are on the upper aspect of the credit score restrict however you’ve been persistently paying your dues on time, the monetary establishment that has lent you the bank card shall be very happy to extend your credit score restrict.

FAQs

Is it protected to examine CIBIL rating on-line?

Sure, the official CIBIL web site is the most secure technique to examine your CIBIL rating on-line.

Is CIBIL rating free?

CIBIL scores and experiences are free yearly for each particular person by way of the official CIBIL web site. A number of web sites would possibly assist estimate your CIBIL rating, however if you wish to preserve monitor of your rating actively, you’ll have to pay sure costs to the official CIBIL web site.

Is credit score rating and CIBIL rating the identical?

Solely CIBIL can calculate and supply the CIBIL rating of a person. Nonetheless, any of the 4 credit score bureaus: CIBIL, Equifax, Experian, and CRIF Excessive Mark, can present a person’s credit score rating. Whereas credit score and CIBIL each are related, most banks will all the time want the CIBIL scores.

What’s NA/NH in CIBIL rating?

NA and NH are acronyms for Not Relevant and No Historical past, respectively. People with no credit score or mortgage historical past fall underneath this class. And in case you are on this class, you must contemplate starting to construct a CIBIL rating, because it turns out to be useful if you’re looking out for a mortgage or bank card.