Stephen Thompson is a senior technical editor at LQwD Fintech Corp. He was a Bitcoin researcher and investigator at BIGG Digital Property, finishing up Bitcoin investigations with evaluation of on-chain and off-chain data.

Belief is the lifeblood of all social interactions. In an atmosphere with excessive ranges of belief, individuals could make transactions in full confidence that their counterparties are who they are saying they’re, and can behave to each celebration’s satisfaction. If there may be low belief in a society, the social penalties are manifold, unpredictable and infrequently violent. Individuals construct buildings and establishments that act as proxies for belief, however these buildings can go improper in methods that may grow to be detrimental to on a regular basis social life. For instance, a financial institution’s community fails, leaving a transaction incomplete; a authorities that begins doing the alternative of what it says it’s going to do; an internet site claiming to uphold free speech that begins censoring undesirable feedback.

How The Web Modified Belief

In our more and more technologized world, society has come to see using digital proxies for communication, commerce and even as a manner of passing the time, as fully regular. We’ve got constructed networks that allow individuals to enter trusted relationships with out ever having met one another. Essentially the most expansive community now we have constructed is the web. The web’s most acquainted app, the World Huge Net, began off as a platform that held huge quantities of knowledge. Nevertheless, there was so little happening with these early net pages {that a} 56k modem on a telephone line was ample to name them up. The web began to grow to be extra highly effective and far more interactive within the mid-2000s with the arrival of e-commerce, social media and networking. It grew to become doable for individuals to make use of the web to switch cash and their private data. This improve within the web’s functionality required a brand new sort of belief: belief that folks’s cash and private data was secure within the palms, not of one other individual, however of a machine, and never simply of 1 machine, however getting transferred between machines and typically throughout completely different networks.

A examine by the Pew Analysis Heart in 2017, surveyed individuals’s angle to the sort of belief individuals had for holding cash and private data on a digital platform. The respondents answered a variety of questions however listed here are a number of the forms of solutions they gave:

- A mix of higher know-how with individuals permitting it to play a extra distinguished function of their lives will enhance belief.

- Authorities and business regulation tailor-made to the character of the web will enhance belief.

- Belief itself will likely be fluid relying on the context.

- Compliance replaces belief as a part of a “new regular” if customers nonetheless need the fruits of the web’s capabilities.

- Blockchain can enhance parts of the web however it won’t be so disruptive by the point it turns into universally adopted.

- Governments and companies have little interest in enhancing belief over the web and legal networks will undermine belief.

I’ve targeted on cash and private data as a result of, within the digital world, these two attributes have merged into what has grow to be referred to as “digital belongings.” Info has simply as a lot worth as cash. In the meantime, nefarious actors have organized themselves into networks which have grow to be adept at attacking different networks. Such nefarious networks are simply as more likely to be looking for personally-identifiable data as they might be looking for cash. The WannaCry virus of 2017 was one such instance the place the hackers had been looking for digital data in addition to funds.

Bitcoin As A New Belief Layer For The Web

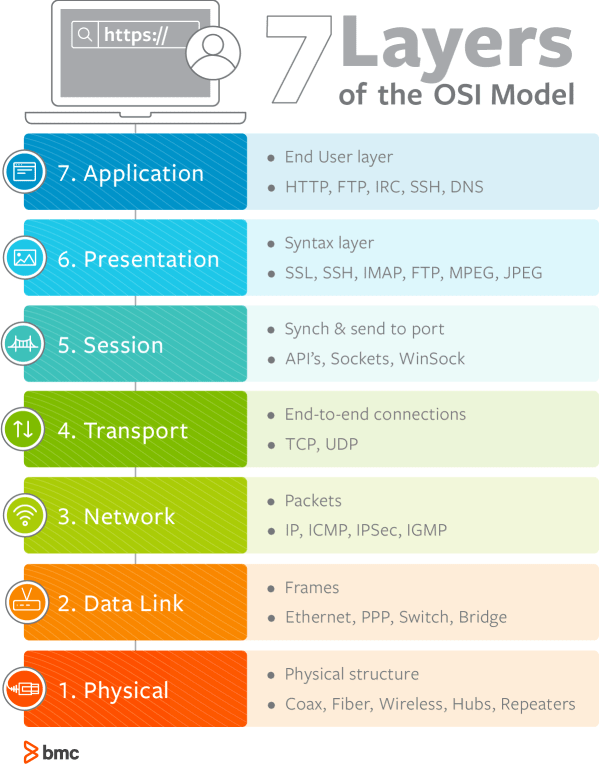

The web at the moment has seven layers as expressed on this mannequin under. That is the Open Techniques Interconnections mannequin (OSI).

The mannequin describes seven layers (from backside to prime):

- Bodily layer for the switch of uncooked information.

- Information hyperlink layer which secures hyperlinks between networked computer systems or nodes.

- Community layer that controls the safe switch of information packets from a node on one community to a node on one other community (like what a VPN would do).

- Transport layer which transfers information sequences of differing lengths from one utility to a different.

- Session layer controls the setup of connections between computer systems which run logins, identify lookup and logouts.

- Presentation layer arranges the info right into a format that the appliance layer can view.

- Utility layer is the place the consumer manipulates software program, similar to Microsoft Workplace or net browsers, in order that it communicates between the shopper and server to carry out sure duties.

It has been argued that this OSI mannequin wants a belief layer that doesn’t create a single level of failure — like downtime — at any stage of the consumer’s interplay with the web.

That is the place Bitcoin is available in. You possibly can converse of Bitcoin the community or bitcoin the asset, however in each circumstances, one can argue that Bitcoin combines cash and data. The Bitcoin community is a belief protocol and we see it because the important belief layer for the web. The Bitcoin protocol is a algorithm that govern the community and defend it from assaults, like tampering with the blockchain, double-spending or spamming the community. We take into account Bitcoin as a much-needed belief layer for the web as a result of it’s trustless. How can this be? “Trustless” implies that there aren’t any entities that customers need to belief with a view to get their data from one node to a different and its eventual affirmation onto the community. As a substitute, the decentralized nature and transparency of the community is the bottom on which Bitcoin’s belief protocol sits. Bitcoin’s personal belief protocol runs on two ranges: the transaction stage, the place customers in a transaction swap their public keys after which signal transactions with their personal keys in order that each customers can know that the transaction was real; the community stage the place hundreds of nodes and miners affirm that the transaction was not spent twice after which broadcast to the blockchain.

Proof-Of-Work For Analytics

What can be the mechanism that may make Bitcoin a viable belief layer for the web? In our guide “Belief and the Rise of Bitcoin,” now we have proposed “proof-of-work for analytics,” which refers back to the quantity of computational effort required to audit the Bitcoin ecosystem in actual time. Customers, individually or in a pool, can apply this proofing by working a full node that surveils web information concerning the present state of the blockchain. In the intervening time, there are millions of full nodes doing simply that. Proof-of-work for analytics helps to discourage world governments and their company businesses from mass surveillance in addition to abusive information mining. The larger the variety of full nodes analyzing the blockchain, the extra information factors there will likely be. Proof-of-work for analytics might be utilized to these areas of the web the place customers’ personal data is most susceptible to mass surveillance, similar to on social media. Principally, we’re proposing that the Bitcoin protocol, utilizing the proof-of-work algorithm, can present the web with a much-needed layer of belief.

Exterior Elements That Influence On Belief

There are different elements that can affect the prospects of the Bitcoin protocol in enhancing belief within the web. The blockchain business, monetary regulators and legislation enforcement businesses will have an effect on Bitcoin as a belief layer for the web. Will their interventions help or hinder blockchain know-how in being reliable from the general public’s perspective?

That is the place we transfer away barely from the Bitcoin-centric notion of belief and towards the kind of belief the place new customers are prepared to make use of Bitcoin not solely as a result of they belief the community to hold out the capabilities that the protocol guarantees, but additionally as a result of they’ve assessed their belief of Bitcoin primarily based on what they’ve heard from the phrases and actions of blockchain corporations, regulators and legislation enforcement businesses. We have to take care of this layman’s thought of belief as a result of the computational belief of the Bitcoin protocol turns into a non-starter if customers do not need standard belief in Bitcoin.

After we take a look at the blockchain business, centralized exchanges have been the store window for bitcoin. If one thing goes improper with an trade wherever, be it a denial-of-service assault, funds stolen or the like, the general public tends to assume that the Bitcoin blockchain itself has been hacked. The mainstream information loves personalities, so, people similar to Gerald Cotten of QuadrigaCX, Alexander Vinnik of BTC-e and Ross Ulbricht of the Silk Highway darkish net market, have all performed their half in making bitcoin appear like a forex that solely renegades would use. The voice of the Bitcoin group is barely heard for 2 causes: The group’s data just isn’t the general public’s go-to supply and the emotive explanations that come from the mainstream information media overpower the technical explanations of the Bitcoiners. As a substitute, it’s the mainstream information media who, as everyone knows, have a style for remarking, “Bitcoin goes all the way down to zero,” or “Bitcoin is simply too risky,” or “Bitcoin is utilized by criminals,” or most not too long ago, “Bitcoin makes use of an excessive amount of vitality.” With that stage of discourse, the place is the opening into which we will introduce the idea of computational belief? And even that the vitality consumption concerned in Bitcoin mining — which is low in comparison with different industrial practices — is the worth one pays for the decentralization and transparency that Bitcoin affords?

The general public sees the evolving relationship between Bitcoin and regulators. Bitcoin has come below the scrutiny of economic regulators albeit at completely different instances, relying on the area. As an illustration, the Mt. Gox collapse in 2014 woke up the East Asian regulators to Bitcoin, however it took the revelations from the Panama Papers in 2016, to carry cryptocurrencies to the eye of European regulators. Monetary regulators world wide consider that bitcoin wants to return below monetary regulation earlier than it may well ever hope to win individuals’s belief after which attain the mass adoption that Bitcoiners have so usually promised themselves.

The monetary regulators have, for essentially the most half, aimed on the centralized exchanges as they’re the biggest companies that stand on the bridge between fiat forex and cryptocurrencies. However regulators confronted a basic downside: Bitcoin is a worldwide community which runs the identical protocol wherever on the earth the consumer is perhaps. Regulators are nation-state-level organizations whose existence predates Net 2.0 and, for some, the web itself: The UK’s Monetary Conduct Authority was established because the Monetary Providers Authority in 1997, america’ Commodity Futures Buying and selling Fee (CFTC) — that has been not too long ago assigned the regulation of bitcoin — was arrange in 1974. These two organizations had been set as much as regulate particular types of monetary exercise. The success of their efforts to cowl bitcoin with their rules (past centralized exchanges), stays to be seen.

In the meantime, Bitcoin retains evolving away from these makes an attempt. An excellent greater problem is it has thus far confirmed troublesome for regulators to coordinate their insurance policies to emulate Bitcoin’s world protocols. In 2018, the Monetary Motion Activity Power (FATF) provided regulators some hope when it revealed world pointers that governments might apply to their very own laws and provides their regulators a greater diploma of synergy when coping with cryptocurrencies.

The FATF revealed its first set of suggestions making use of to bitcoin in 2018. It required companies that transferred any type of digital forex to be termed as VASPs (digital asset service suppliers). Centralized exchanges had been amongst these companies going through these new necessities. Most importantly for bitcoin, the FATF was trying to apply the “journey rule” to bitcoin transactions. These VASPs receiving bitcoin value $10,000 or extra had been required to report the transaction quantity, the payer’s actual data and account quantity to their native legislation enforcement businesses and monetary intelligence items as if the transaction was an act of cash laundering or terrorism financing. This factors to the FATF’s perception that labeling bitcoin transactions with actual data will enhance belief in bitcoin.

The character of their makes an attempt at cryptocurrency regulation have targeted on cash laundering and terrorist financing, so a key focus of regulation has been to require the exchanges to finish know-your-customer (KYC) and anti-money-laundering (AML) checks on new customers.

Conclusion

Bitcoin is an open-source financial community that conceives of belief as computational effort within the type of proof-of-work. The trouble by regulators to realize belief includes breaking of Bitcoin’s belief protocols that make it safe — pseudonymity being one in every of them. In impact, regulators’ belief requires the breakup of Bitcoin’s belief. The blockchain business actually is caught within the center as they attempt to persuade the general public to undertake this new sort of cash whereas below strain to adjust to regulators’ conception of belief, throughout which, they could be referred to as upon to run public-relations damage-limitation workout routines at any time when their platforms are attacked. We stay up for the success of Bitcoin, because it supplies an avenue of computational belief that vouchsafes the safety of the community — one thing that central bank-controlled fiat currencies are usually not designed to do.

It is a visitor publish by Stephen Thompson. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.