California governor and presidential hopeful Gavin Newsom lately reached an settlement with state legislators on yet one more spherical of cheques to be mailed to households across the state (Luna 2022). Households will obtain as much as $1,050 in money from the state authorities, in a manoeuvre estimated to value virtually $10 billion. This follows two earlier rounds of so-called Golden State Stimulus funds to California residents in 2021.

All of it constitutes fairly the change of tune from Could 2020, when Newsom proposed vital spending cuts in response to the downturn triggered by the Covid-19 pandemic (Workplace of Governor Gavin Newsom 2020). What occurred?

Within the early months of the pandemic, analysts and policymakers alike expressed vital concern in regards to the impression the preliminary downturn and widespread lockdowns would have on state and native budgets (Bartik 2020, McNichol et al. 2020). As state and native governments within the US are usually sure by balanced-budget necessities, lowered revenues can set off sudden disruptions of service provision and curtail the employment of state and native authorities staff (Clemens and Miran 2012, Shoag et al. 2019). To keep away from such turmoil, the federal authorities has assumed duty for the stabilisation of state and native budgets.

And assume duty it did. Throughout 4 main Covid-19 reduction payments, the federal authorities allotted about $900 billion in funds to state and native governments. This was in step with essentially the most pessimistic estimates of income from early within the pandemic (e.g. Bartik 2020). These estimates, nonetheless, ended up dramatically overestimating the impression the pandemic would in the end have on state and native budgets. In truth, state tax revenues since early 2020 have exceeded pre-pandemic forecasts (Dougherty and de Biase 2021, Nationwide Affiliation of State Price range Officers 2021).

There are two essential the reason why early forecasts of income losses missed the mark (Clemens and Veuger 2020, forthcoming). First, they didn’t account for the opposite elements of the coverage response to the downturn, which included unprecedented quantities of help for households and companies in addition to the fast improvement and deployment of vaccines. These insurance policies not directly supported state and native governments’ tax bases, making direct help to state and native authorities much less obligatory. Second, they ceaselessly relied on historic relationships between macroeconomic indicators and income that had been fairly completely different in the course of the Covid-19 disaster.

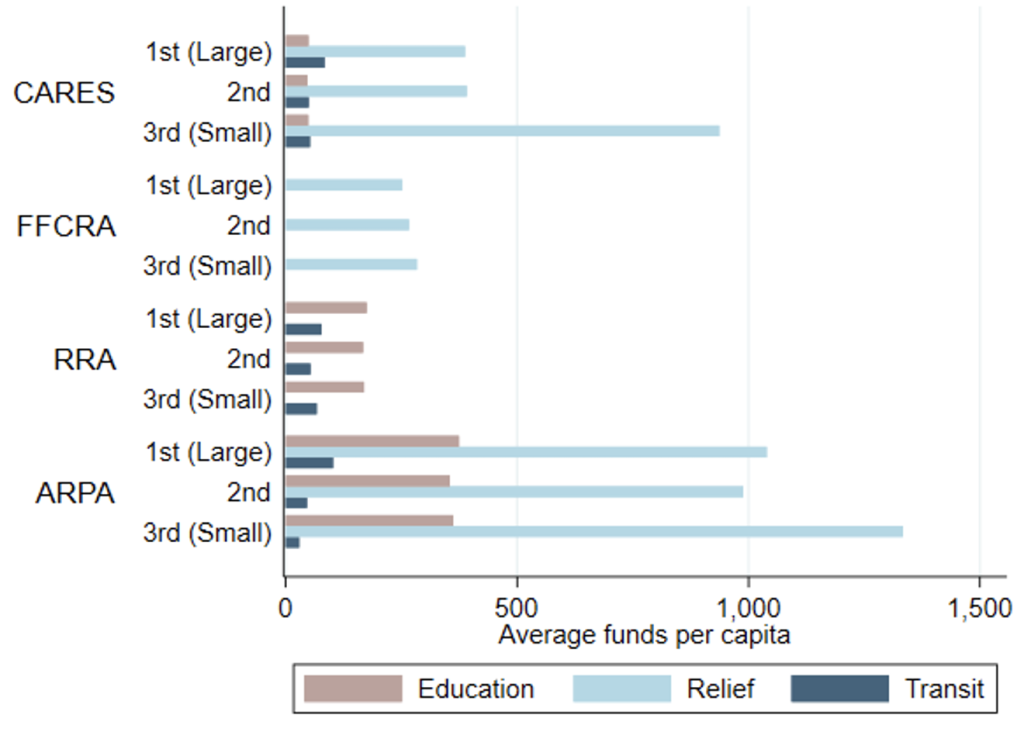

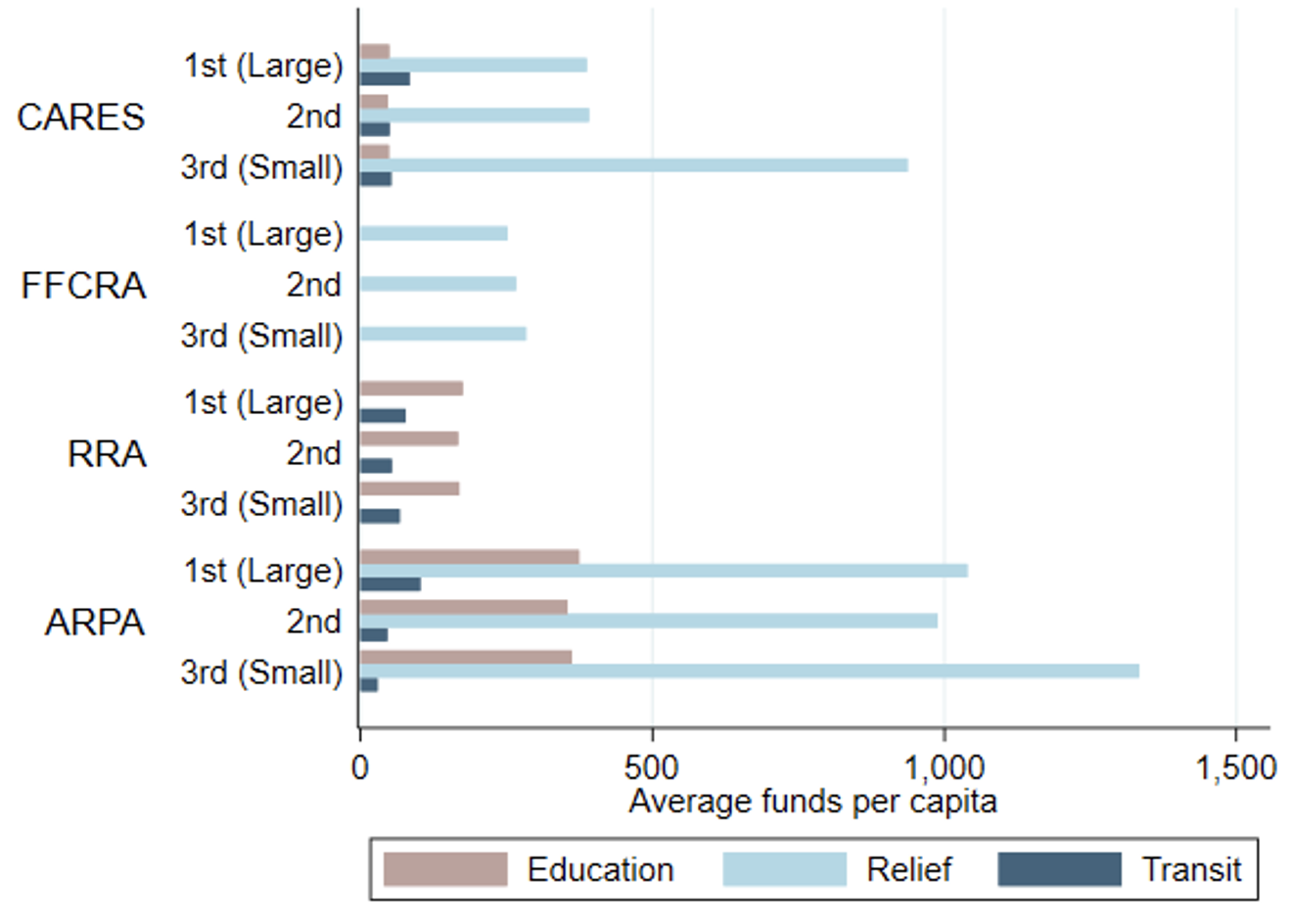

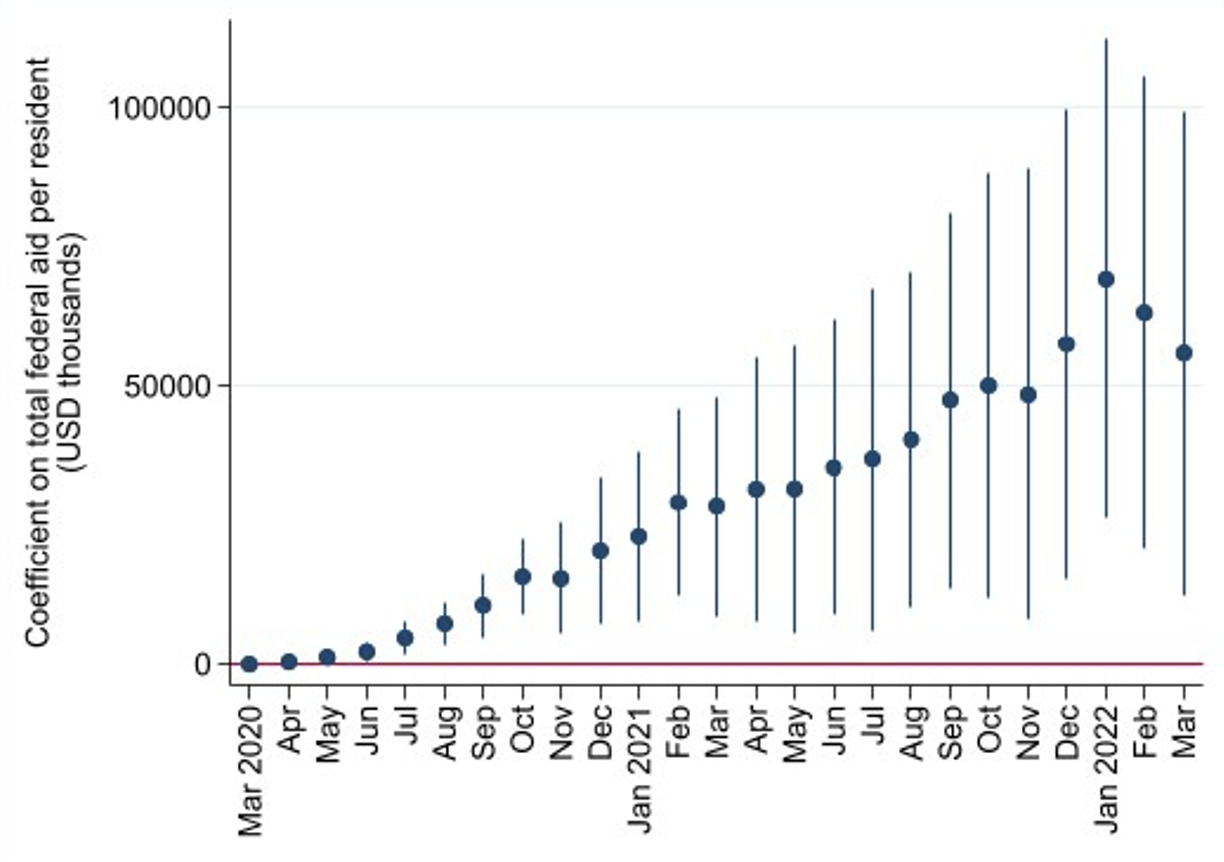

We assess the results of the maybe overly beneficiant federal fiscal help to state and native governments in Clemens et al. (2022a, 2022b). In each papers, we exploit the truth that allocations of federal help had been way more beneficiant to the residents of states which might be extra favourably represented in Congress than to the residents of states which might be much less favourably represented. Illustration doesn’t scale proportionately with inhabitants, largely as a result of every state elects exactly two Senators no matter its inhabitants, and partly as a result of every state will get a minimum of one member of the Home of Representatives. The ensuing over-representation of low-population states (or ‘small’ states) strongly predicts their help allocations. This leads us to make use of a measure of states’ per-resident congressional illustration as an instrumental variable. As Determine 1 (from Clemens and Veuger 2021) illustrates, this ‘small-state bias’ led to vital variations within the quantity of Covid-19 reduction funding per resident acquired by the general public sector in small states relative to massive states.

Determine 1 Help per resident by degree of congressional illustration

The variations in federal funds flowing to completely different states predicted by variations in congressional illustration can’t be defined by different components, resembling prognosticated income shortfalls, severity of the menace to public well being, or different proxies for funding wants. In consequence, they permit us to keep away from a normal supply of bias, specifically that help tends to move most generously to states in best want, as we estimate the impression of fiscal help on macroeconomic outcomes.

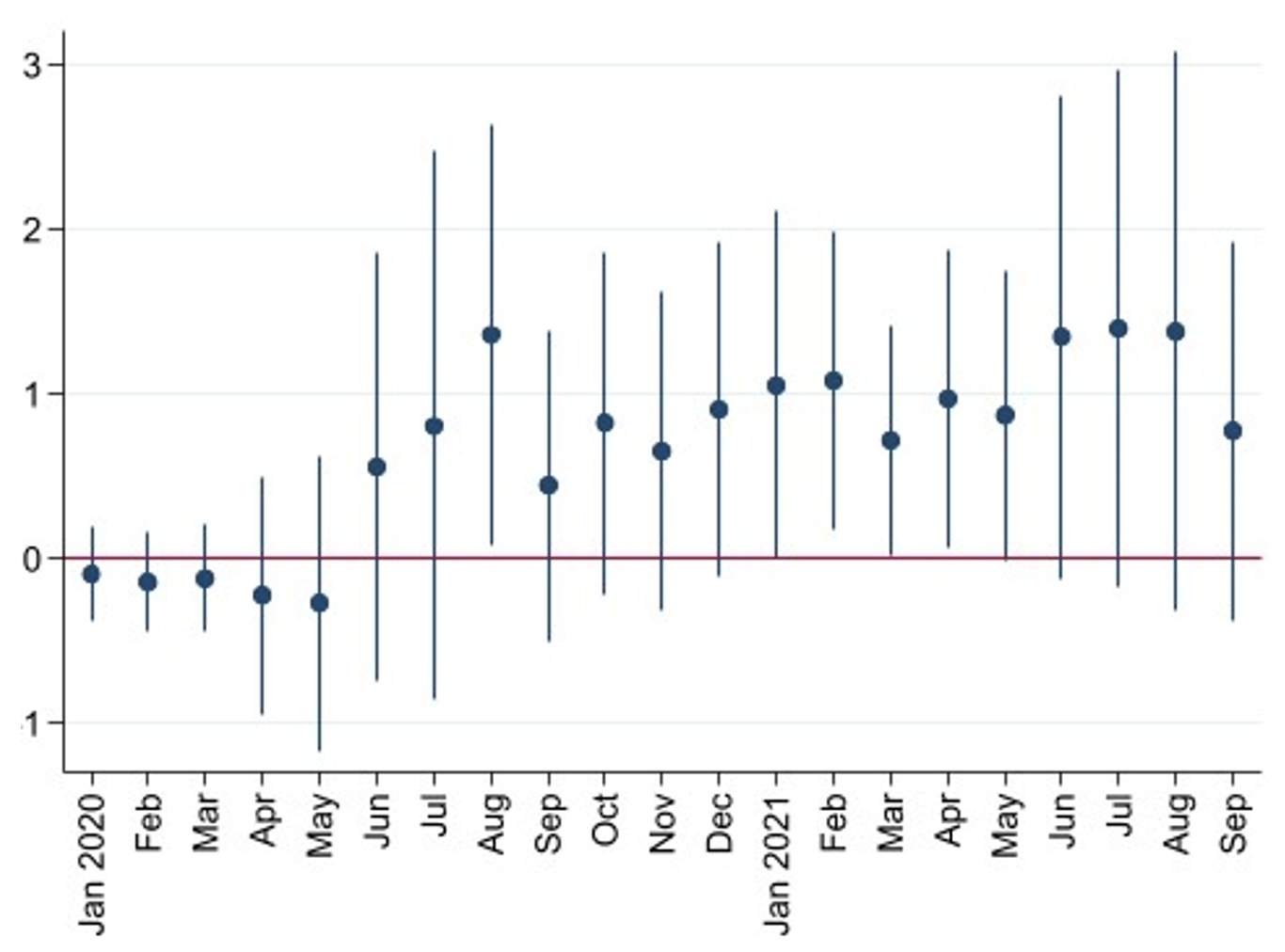

The primary and essential end result of curiosity we analyse in Clemens et al. (2022b) is state and native authorities employment. Preserving state and native authorities employment is vital each in and of itself, to make sure continued service provision, and for its position in stabilising the broader macroeconomy.

Determine 2 reveals the local-projection impulse response of state and native authorities employment to fiscal help. It signifies that every $1 million in help preserved modestly lower than 18 public sector job-months throughout the 18 months of our pattern, or to place this in additional acquainted phrases, fiscal help of $855,000 was allotted for every state or native authorities job-year preserved. This quantity is sort of excessive relative to comparable estimates from previous downturns. Analysis on the results of elements of the 2009 American Restoration and Reinvestment Act, for instance, has estimated prices per job-year starting from $26,000 to $202,000 (Chodorow-Reich et al. 2012, Wilson 2012, Conley and Dupor 2013). Within the pandemic context, the Paycheck Safety Program has been estimated to value between $169,000 and $258,000 per job-year (Autor et al. 2022a, 2022b).

Determine 2 Results of federal help per resident on state and native authorities employment

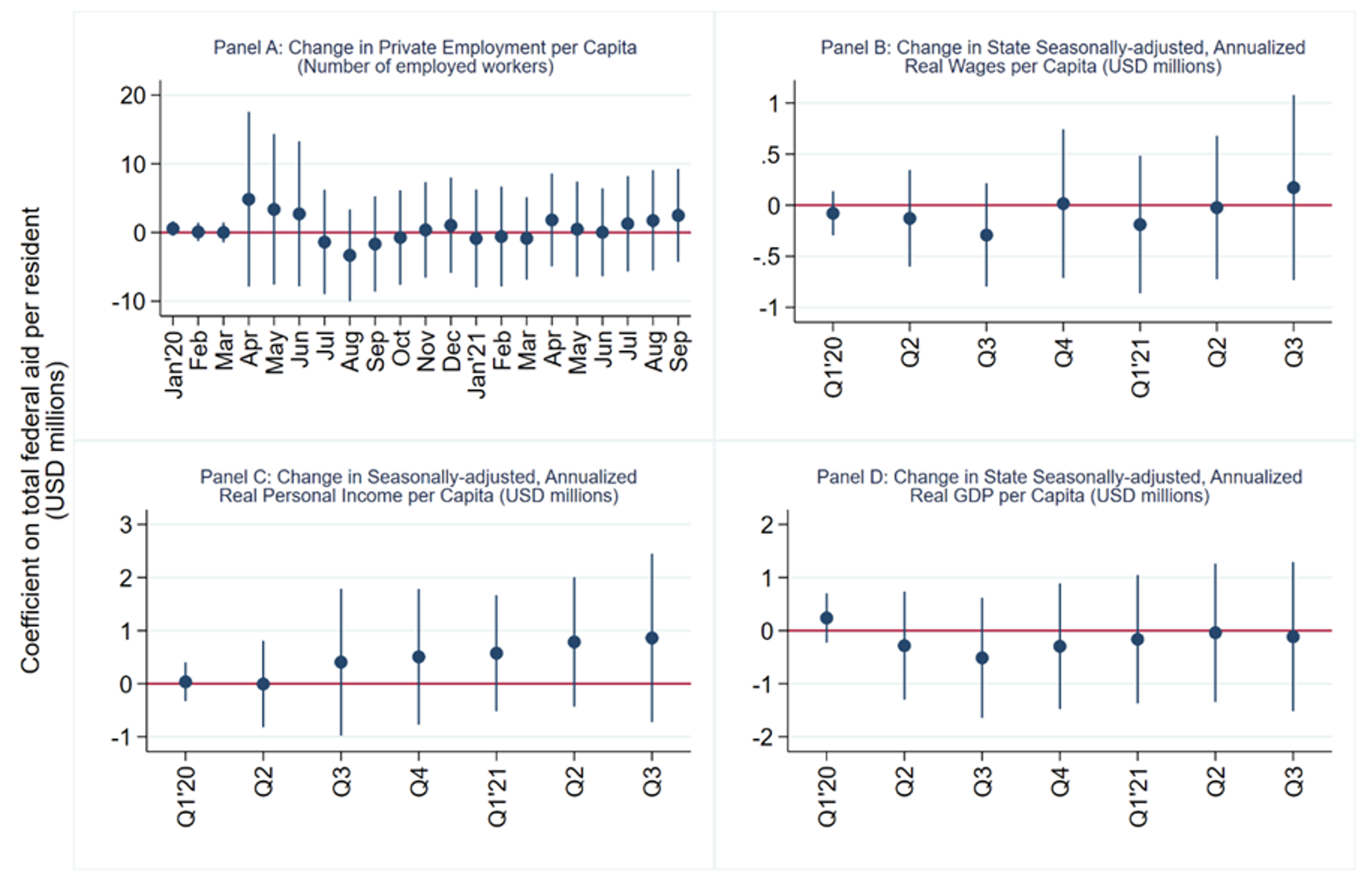

Determine 3, from the identical paper, reveals that the impression on the broader financial system was (even) extra modest (see additionally Auerbach et al. 2021). Federal help to states and localities doesn’t seem to have had a statistically considerably impact on private-sector employment, wages, earnings, or output. This too could be contrasted with previous work on the multiplier results of federal spending (e.g. Inoue et al. 2022). Estimates from historic downturns from the Nice Despair by way of the Nice Recession have tended to supply multiplier estimates that vary between 0.5 and a pair of (Ramey 2019, Chodorow-Reich 2020).

Determine 3 Results of federal help per resident on macro outcomes

In Clemens et al. (2022a), we and John Kearns report some extra constructive findings. Federal help seems to have helped states roll out simpler testing operations. As proven within the determine beneath, the testing benefit of states that acquired extra federal funds has grown steadily because the summer time of 2020.

Determine 4 Results of federal help per resident on whole Covid-19 assessments administered per 100,000

In our evaluation of states’ vaccination campaigns, we discover that states that acquired extra federal funds per resident didn’t outperform their friends by having increased vaccination charges. It does seem that better federal funds have led to extra equitable vaccination patterns: states that acquired extra federal cash noticed smaller gaps come up between the vaccination charges of residents with a school training relative to these with a highschool training.

The general image painted by the work summarised right here means that federal help to state and native governments was solely modestly efficient, if that, as a macroeconomic stimulus. Along with the overly beneficiant help allotted to state and native governments, two components are doubtless key in explaining this. First, for a lot of the previous two years, the general public well being scenario led governments to impose restrictions on, and households and companies to voluntarily chorus from, a variety of financial exercise. These restrictions and voluntary pullbacks on financial exercise could have shut down a key mechanism by way of which fiscal stimulus historically operates. Second, properly earlier than state and native governments made use of the complete quantity of funds they had been allotted, the financial system had entered a interval of great inflationary strain. This units the current macroeconomic context aside from, for instance, the interval after the worldwide disaster, when mixture demand shortfalls had been rampant.

The extent to which federal funds have superior different objectives of curiosity stays to be seen. Our evaluation of states’ testing and vaccination campaigns means that federal funds have superior a minimum of some targets of curiosity. The consequences of federal funds on training, regulation enforcement, and different native public providers will have to be assessed in future analysis.

References

Auerbach, A, Y Gorodnichenko, P B McCrory and D Murphy (2021), “What Covid-19 Teaches Us About Fiscal Multipliers”, VoxEU.org, 23 December.

Autor, D, D Cho, L D Crane, M Goldar, B Lutz, J Okay Montes, W B Peterman, D D Ratner, D Villar Vallenas and A Yildirmaz (2022a), “An Analysis of the Paycheck Safety Program Utilizing Administrative Payroll Microdata”, NBER Working Paper 29972.

Autor, D, D Cho, L D Crane, M Goldar, B Lutz, J Okay Montes, W B Peterman, D D Ratner, D Villar Vallenas and A Yildirmaz (2022b), “The $800 Billion Paycheck Safety Program: The place Did the Cash Go and Why Did it Go There?”, Journal of Financial Views 36(2): 55-80.

Bartik, T J (2020), “An Up to date Proposal for Well timed, Responsive Federal Help to State and Native Governments Throughout the Pandemic Recession”, W.E. Upjohn Institute for Employment Analysis, 22 Could.

Chodorow-Reich, G (2020), “Regional Information in Macroeconomics: Some Recommendation for Practitioners”, Journal of Financial Dynamics and Management 115: 103875.

Chodorow-Reich, G, L Feiveson, Z Liscow and W G Woolston (2012), “Does State Fiscal Aid throughout Recessions Improve Employment? Proof from the American Restoration and Reinvestment Act”, American Financial Journal: Financial Coverage 4(3): 118-45.

Clemens, J, P Hoxie, J Kearns and S Veuger (2022a), “How Did Federal Help to States and Localities Have an effect on Testing and Vaccine Supply?”, NBER Working Paper 30206.

Clemens, J, P Hoxie and S Veuger (2022b), “Was Pandemic Fiscal Aid Efficient Fiscal Stimulus? Proof from Help to State and Native Governments”, NBER Working Paper 30168.

Clemens, J and S Miran (2012), “Fiscal Coverage Multipliers on Subnational Authorities Spending”, American Financial Journal: Financial Coverage 4(2): 46-68.

Clemens, J and S Veuger (2020), “Fiscal Federalism and the COVID-19 Shock within the US”, VoxEU.org, 28 September.

Clemens, J and S Veuger (2021), “Politics and the Distribution of Federal Funds: Proof from Federal Laws in Response to COVID-19”, Journal of Public Economics 204: 104554.

Clemens, J and S Veuger (Forthcoming), “Classes from COVID-19 Help to State and Native Governments for the Design of Federal Automated Stabilizers”, Aspen Financial Technique Group.

Conley, T G and B Dupor (2013), “The American Restoration and Reinvestment Act: Solely a Authorities Jobs Program?”, Journal of Financial Economics 60(5): 535-549.

Dougherty, S and P de Biase (2021), “State and Native Authorities Funds within the Time of COVID-19”, VoxEU.org, 26 October.

Inoue, A, B Rossi and Y Wang (2022), “Why Fiscal Multipliers Estimates Change over Time and What Determines Their Magnitude”, VoxEU.org, 14 April.

Luna, T (2022), “Deal Reached on Plan for Greater than $9 Billion in Fuel Refunds to California Drivers”, Los Angeles Instances, 24 June.

McNichol, E, M Leachmen and J Marshall (2020), “States Want Considerably Extra Fiscal Aid to Gradual the Rising Deep Recession”, April 14, Heart on Price range and Coverage Priorities.

Nationwide Affiliation of State Price range Officers (2021), “The Fiscal Survey of the States: Fall 2021. An Replace of State Fiscal Circumstances”.

Workplace of Governor Gavin Newsom (2020), “Governor Newsom Submits Could Revision Price range Proposal to Legislature 5.14.20”, 14 Could.

Ramey, V (2016), “Macroeconomic Shocks and Their Propagation”, in J B Taylor and H Uhlig (eds.), Handbook of Macroeconomics 2: 71-162.

Ramey, V (2019), “Ten Years After the Monetary Disaster: What Have We Discovered from the Renaissance in Fiscal Analysis?”, Journal of Financial Views 33(2): 89-114.

Shoag, D, C Tuttle and S Veuger (2019), “Guidelines Versus House Rule: Native Authorities Responses to Detrimental Income Shocks”, Nationwide Tax Journal 72(3): 543-574.

Wilson, D J (2012), “Fiscal Spending Jobs Multipliers: Proof from the 2009 American Restoration and Reinvestment Act”, American Financial Journal: Financial Coverage 4(3): 251-282.