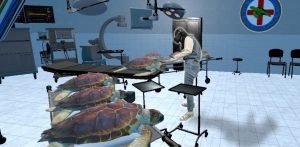

Welcome to the brand new world, the place bodily actual property is so final century and digital land swaps transact in cryptocurrency somewhat than {dollars}. The concept behind the metaverse is that finally this turns into the following section of the Web, through which folks socialize and conduct enterprise nearly and wish higher locations to go than Zoom.

Confused but? Simply ask your youngsters to elucidate the sport platforms Fortnite and Roblox, a kind of digital actuality that has already taken over the universe, er, metaverse.

But when metaverse actual property ever good points traction with the broader public, how does one even go about pricing it?

In actual life, Boston is a extremely costly actual property market largely due to the shortage of obtainable housing. However the metaverse theoretically may by no means see a housing drought if you happen to can simply maintain coding out more room.

“Shortage has been the foremost element in defining the worth of land over the course of time,” stated James Scott, director of the MIT/CRE Actual Property Expertise Initiative. “Does that shortage exist within the metaverse? Or is it simply the phantasm of shortage? Regulation and coverage will should be extra clearly outlined and applied earlier than this shortage turns into a actuality.”

It seems the phantasm of shortage is already driving up gross sales quantity, although the metaverse continues to be a methods off from changing into a product for on a regular basis customers. At this time, it’s akin to a digital frontier the place early operators run on some fashionable iteration of “Go West, younger man.”

Actual property gross sales throughout the 4 main metaverse platforms (Sandbox, Decentraland, Voxels, and Somnium Area) totaled $501 million in 2021, in accordance with MetaMetric Options. Previous to the crypto crash of latest weeks, gross sales have been projected to high $1 billion this 12 months.

Arguably the best-known instance of increasing concentrate on the metaverse arrived final 12 months when Fb rebranded its mum or dad firm as Meta, signaling the place future assets would largely middle.

However quite a lot of that is obscure big-picture stuff. How massive is that this going to get, and what number of Bostonians are literally going to care? There are solely so many plots of e-land to purchase subsequent to a hypothetical digital Tom Brady mansion.

“The consumers of this stuff are typically crypto speculators,” stated Janine Yorio, CEO of Everyrealm, a metaverse actual property investor and advisory agency. “The value of Metaverse actual property ranges from about $500 per parcel to as a lot as $10,000 per parcel. So whereas it’s costly, it’s nonetheless very attainable for the overwhelming majority of people that have an curiosity in doing this kind of factor —so there are each particular person consumers and bigger company entities.”

The pool of consumers additionally tends to be small: A report earlier this 12 months by Everyrealm discovered that solely 25,000 crypto wallets held metaverse actual property.

“Whereas there are numerous completely different entities that maintain the asset class, it’s really concentrated within the fingers of a really small variety of folks and corporations,” Yorio stated.

After all, loads has transpired within the economic system since most of the metaverse actual property sale offers passed off earlier this 12 months. The general cryptocurrency market skilled a roughly $2 trillion valuation wipeout between November of final 12 months and early June, Bloomberg reported.

However not everyone seems to be blaring a warning siren for the metaverse simply because an enormous supply of its financing cratered.

“Whereas the crypto market crash is actually not an excellent factor for the market as a complete, we do consider long-term the metaverse may be very impartial from crypto because it’s extra about social media, video video games, and a brand new media channel than it’s about crypto hypothesis,” Yorio stated.

So what are the nuts and bolts of shopping for digital actual property? Transactions normally contain cryptocurrencies linked to one of many main metaverse platforms. For instance, MANA cryptocurrency is used to purchase property on Decentraland.

A possible purchaser may put a suggestion on any land listed on Decentraland’s market. When a vendor accepts a bid, the acquisition is recorded through a nonfungible token (higher often known as an NFT). Consumers want a digital pockets able to holding NFTs to retailer the possession file. (MetaMask is a well-liked digital pockets.)

However some analysts warning that for the common investor, it could nonetheless be too early to make vital enterprise or private actual property funding selections within the metaverse.

“For those who’re speaking to plenty of folks inside the actual property world, actually on the [venture capital] aspect, who typically are on the excessive finish of funds on the subject of this ingredient of funding, they’d say themselves that they really feel that it’s nonetheless too early to make massive investments within the space,” stated Scott, from the Actual Property Expertise Initiative at MIT. “The expertise, the regulation, and the understanding usually are not but there to contemplate this a real worth funding.”

Lengthy story quick: The common Bostonian most likely isn’t serious about a metaverse land seize in lieu of shopping for a home within the suburbs.

“There are too many unknowns to beat with respect to what position actual property performs within the metaverse at this second in time,” Scott stated. “However there isn’t a doubt [that] social interplay, collaboration, retail, and particular person expertise will lead the motion in direction of adoption of this innovation.”

Yorio urges warning earlier than novice buyers even take into account making a deal for actual property within the metaverse.

“It’s in the end an early-stage enterprise funding constructed on high of a crypto layer,” she stated. “It’s each extremely dangerous and extremely unstable and, even if there could in some unspecified time in the future sooner or later be the chance to generate recurring earnings within the type of a rental stream or one thing comparable or another form of monetization, the actual fact is it’s a extremely unstable, extremely dangerous funding, and, in that method, is nothing like actual world actual property.”

The metaverse actual property recreation is actually an extended one, however consultants say it is usually a generational one.

“Take into consideration how a lot time youngsters are taking part in on Roblox, and so they’re simply going to return to anticipate to dwell in these digital worlds,” stated Jake Steinerman, head of group at cultural metaverse platform Spatial. “[They] are spending a lot cash on their digital clothes [and] on worlds that they’re constructing. They’re spending loopy quantities of cash.”

The times of constructing with a completely fictional pockets on Sim Metropolis? We hardly knew ye — however possibly don’t low cost the metaverse as a viable place to do actual property offers someday sooner or later.

Cameron Sperance could be reached at [email protected]. Subscribe to the Globe’s free actual property e-newsletter — our weekly digest on shopping for, promoting, and design — at pages.e-mail.bostonglobe.com/AddressSignUp. Observe us on Twitter @GlobeHomes.